While businesses and individuals moving for tax purposes is not something new, there has been a recent trend of relocations from high-tax states like California, New York, and New Jersey to low-tax states, particularly Florida and Texas.

One of the main factors contributing to this move, the SALT (state and local tax) deduction cap of the 2017 Tax Cuts and Jobs Act affected a number of high-income earners by limiting the deduction for property and state income taxes to a mere $10,000. According to a 2019 Treasury Inspector General report, the SALT cap was estimated to reduce benefits for 10.9 million taxpayers, amounting to $323 billion in lost deductions.

Then, 2020 brought us the COVID-19 pandemic and the resulting widespread remote work arrangements. The percentage of employees telecommuting full time increased from 17% to 44%, affording millions of people the mobility to work from anywhere. While many of the migrants moved to be closer to family or for personal health reasons, the pandemic was also the opportune moment for some to capitalize on the tax benefits of relocating.

Let’s look at the top three tax advantages of a move down south or west to one of the low-tax states.

1. Pay Lower State Corporate Tax

Oracle, Hewlett-Packard, and Tesla all recently announced their plans to move their business operations from California to Texas. While leaving Silicon Valley is a shocking idea for many, the tax incentives for these and many other corporations make perfect financial sense. After all, California ranks 49th in overall business tax climate.

Corporate executives may also consider moving their enterprise to a low-tax state in order to minimize capital gains taxation if they are planning on selling the business in the future.

2. Avoid State and Local Income Taxes

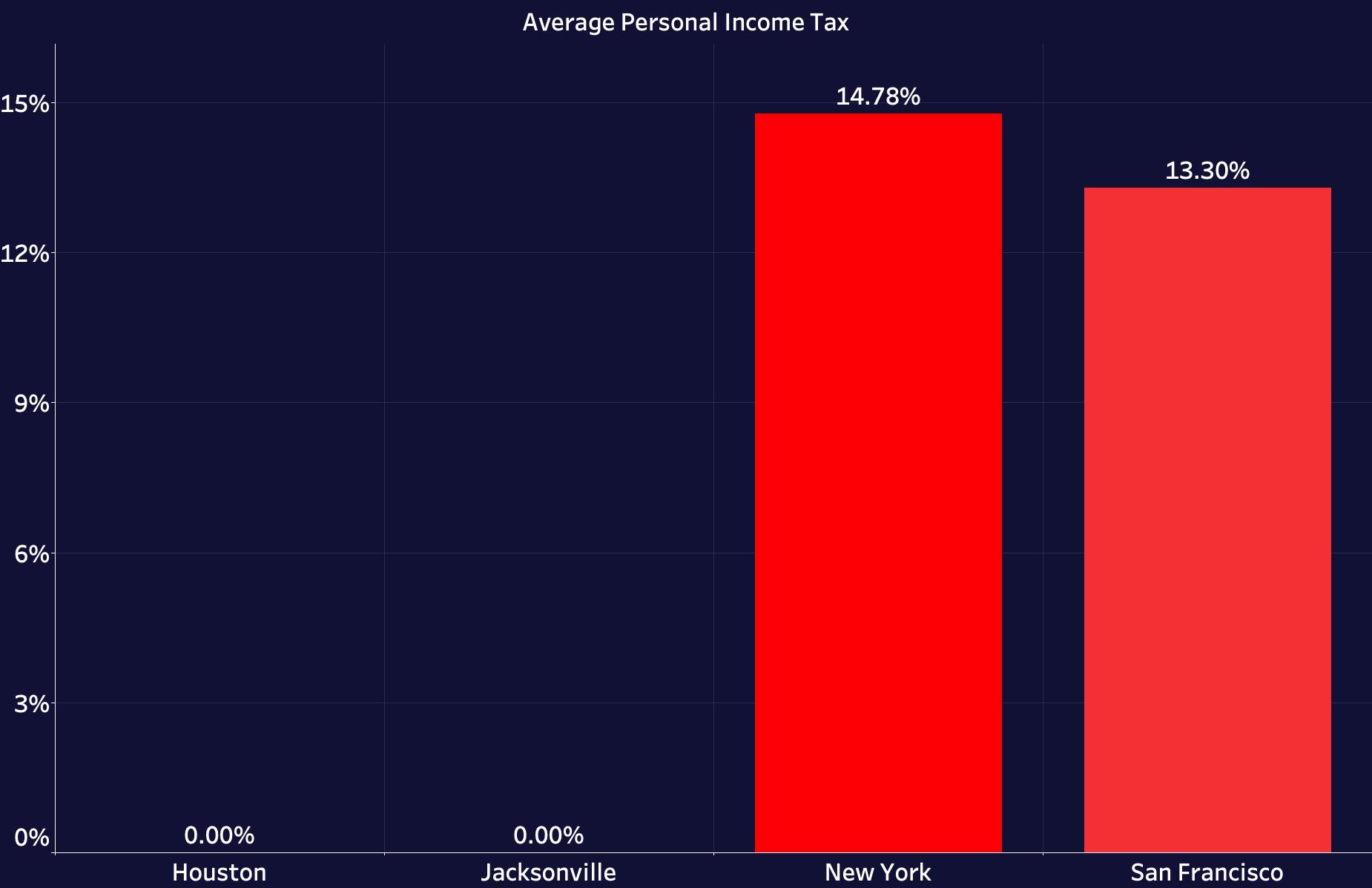

Nine states in the U.S. do not impose state income tax. In contrast, the highest income bracket in the state of New York is taxed nearly 11%. Moving to Florida, Texas, or one of the other states without income tax can result in thousands of dollars in savings annually for high earners.

For example, even a modest AGI of $200,000 will cost a New York family $10,748 a year in state income tax alone. Whether you’re a CFO of a large corporation looking out for your employees or a sole entrepreneur managing your family’s finances, avoiding state income tax can be a pretty compelling reason to consider a relocation.

3. Pay Lower Property Taxes

Another large chuck of high earners’ income residing in high-tax states goes to property taxes. For example, a NJ resident can cover their entire property tax bill in Florida with two months’ worth of property taxes in their state.

Corporations are equally affected by high property taxes as both full-service and triple net leases include property tax charges. Whether you prefer to own or lease your offices and warehouses, operating out of a state with lower property taxes can certainly make a difference to your bottom line.

While these tax advantages sound pretty enticing, moving your business or household to another state is by no means a simple and straightforward process. One state may offer lower corporate tax but impose higher property taxes than the locale you are trying to leave. In addition, you need to take into account not only the tax implications but also all the other costs associated with relocation, in order to make the right decision. Discussing your plans with your tenant representative can help you determine the impact of your move from a real estate perspective.

Reach out to iOptimize Realty® today to learn how we can help with the decision to move your business from a high tax state to a low-tax or no tax state!

Here are a few other articles we think you'll enjoy:

7 Advantages to Having Suburban Office Space

3 Reasons Business-Friendly Cities Increase Corporate Profits

5 Reasons Why Companies Are Fleeing CA and NY for FL and TX

Subscribe to our blog for more CRE tips!!