Want to know a secret about your existing commercial lease? It's losing you money... and the biggest culprit?

Your rent escalation clause.

How do we know this? Tenant Reps, it is our jobs to identify when leases do not benefit the budgets of our corporate clients. We have seen how much strain a poorly negotiated escalation clause can have on your bottom line. So if you want to learn more about your rent escalation and how you can ensure that it's drafted in your interest, this article is for you.

The Escalation Clause in Your Commercial Lease

Escalation Clause in a Renewal Option

Operating Cost Escalations Can Be Handled in Different Ways

Renegotiate Your Rent Escalation with a Tenant Rep

The Escalation Clause in Your Commercial Lease

Unless you were lucky enough to negotiate a lease that remains fixed for its entire life (and by lucky we mean that you found a magic lamp), you will have to deal with the provisions of its escalation clause. A commercial escalation clause is always included in commercial real estate leases. It allows the landlord to increase the rate of your rent according to a specific timeline or according to certain triggers included in the clause.

As a result of the inclusion of the commercial escalation clauses, your rent will not be fixed over time. Increases will build and create a huge impact on your occupancy cost over the period that your lease spans.

When Does Your Rent Escalate?

This clause determines when your lease payments will go up and how much they will cost you. While escalations might seem far away when you first sign your lease, they will come into play eventually.

Ok, but when will your rent go up?

This is one of the first factors the clause will cover (and it will largely depend on negotiations with your landlord).

Rent escalations typically occur at one of three times:

-

Annually (usually on the anniversary of the lease's effective date)

-

After a set number of years (frequently every three or every five)

-

At the execution of a renewal option

However, most leases have annual increases upon the lease's anniversary date. If your rent payments started on March 1, you can expect them to go up on March 1 next year.

How Does Your Rent Escalate?

Typically, your can expect your rent to escalate in one of four ways.

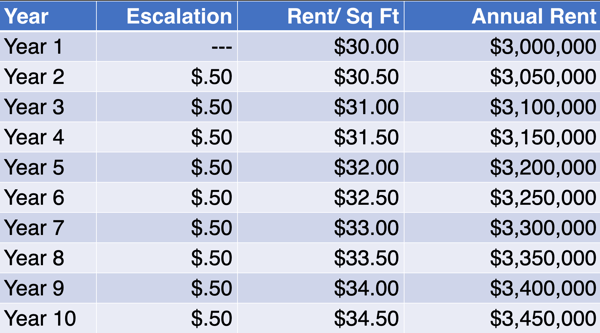

1. Fixed Bump. These increases are for a set dollar amount per foot (or for the entire space). For instance, your $30 per square foot lease might go up by 50 cents per year. Bear in mind that this could mean that the increase goes down on a percentage basis over time. Fixed bumps are most often seen for warehouse or industrial leases.

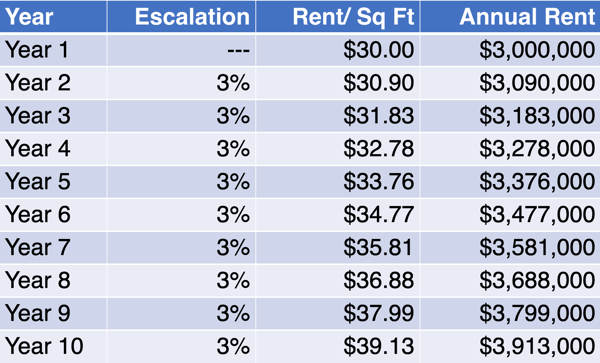

2. Percentage Increase. In this structure, your rent escalates by a set percentage. So, if you have a $30 per square foot lease with 3 percent annual increase, it would go up to $30.90 in the next year, then $31.83 the year after that. These increases compound, which can add up over time. Most often, this will be the type of escalation you want. You know exactly what you're dealing with and have your elevating financial responsibilities clearly laid out for the remainder of your lease's term.

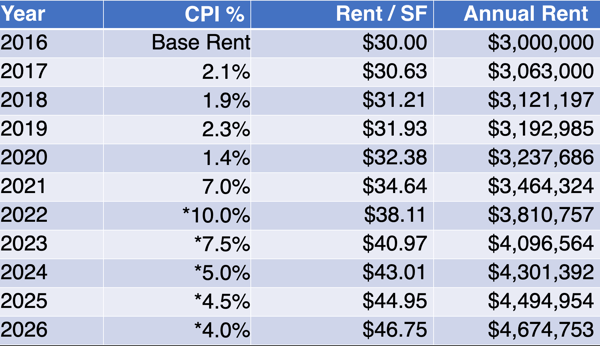

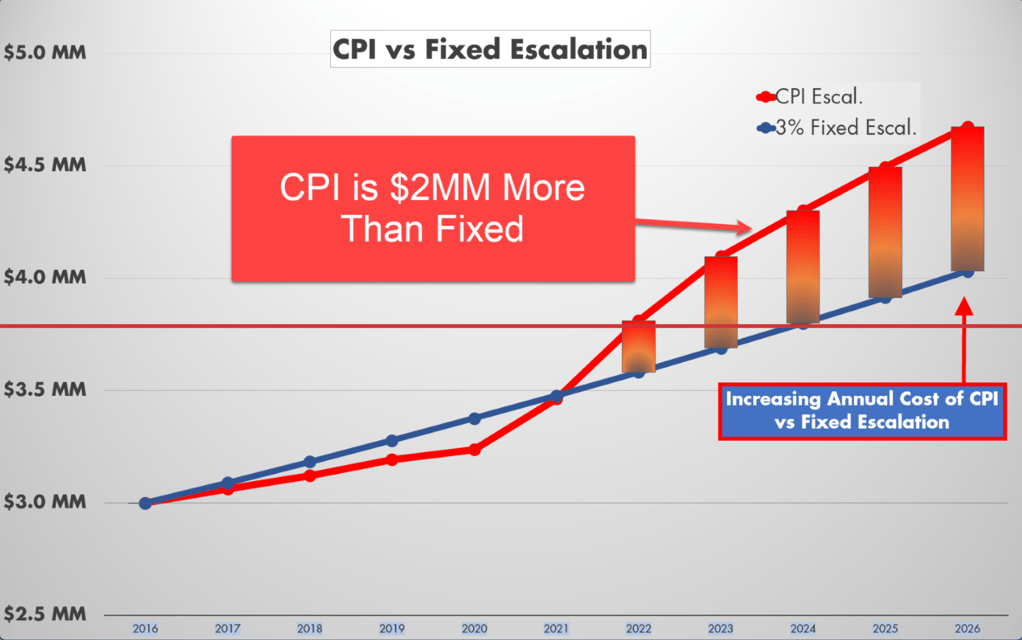

3. Consumer Price Index (CPI) or other inflation-based increases. The CPI provides a monthly measurement of the impact of inflation on a basket of goods and services—food, housing, transportation, medical costs, entertainment, and other items. When you have a CPI escalation clause, your rent will go up in sync with a pre-defined measure of inflation. If inflation is low, your escalation is minor. But if inflation spikes, your rent shoots up with it. (Ouch!)

|

Under no circumstances do you want to leave your long-term budget vulnerable to volatile and expensive escalations. |

Avoid CPI escalations at all costs. While it may initially seem reasonable that your landlord wants to "safeguard themselves against inflation," do you know who will be taking the brunt of skyrocketing costs? That's right-you. Look how quickly you could find yourself victim to egregious escalations.

*Estimated

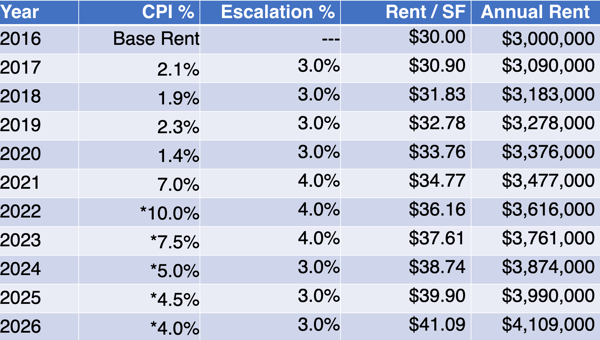

4. Hybrid Escalation. This occurs when inflation is high, and the landlord won't concede to a percentage increase. A combination (hybrid) of CPI and percentage increases will instead be utilized. It is a predetermined, bracketed fixed rate that goes up a small amount if CPI hits certain benchmarks. It could then go back down if inflation returns to lower levels.

*Estimated

No matter what type of rent escalation is stipulated by your lease agreement, it is important that you take the time to calculate increases on your own. If you can't arrive at the same figure as your landlord, ask to be shown exactly how the increase was determined.

Escalation Clause in a Renewal Option

Many leases contain renewal options set to a percentage, usually 95%, of the Fair Market Value (FMV) for space at the time of the renewal. A renewal clause like this has two key problems:

-

This begets the question: What will the fair market value be at the time of renewal? (This is anyone's guess)

- The 95% of FMV protects the landlord, but is quite nebulous as you can get into a dispute as to what FMV is at the time of renewal

As Tenant Reps, we want our clients to continue the fixed rate escalation at the time of renewal. The advantages for the tenant are:

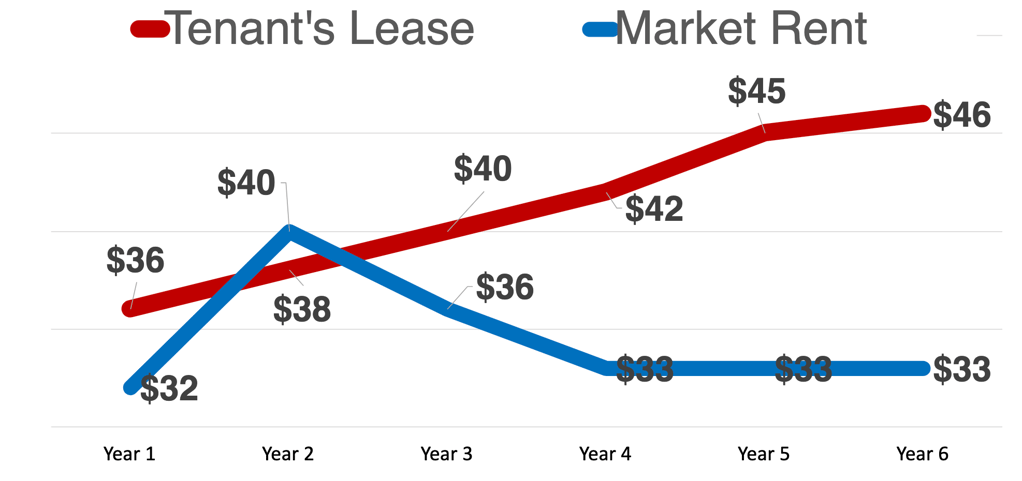

- You know exactly what your rent will be if you choose to exercise your renewal option. It can be no higher than this amount.

- If market rents have dropped below the rent of the fixed escalation rate, then you, as the tenant, do not have to exercise your renewal option, but instead can renegotiate your lease based upon the new, lower market rents.

We highly advise you to use a Tenant Rep to assist you with this, as the landlord will not just roll over and give you the advantage of the lower market rent unless pushed to do so by competitive pressures.

Operating Cost Increases Can Be Handled in Different Ways

Normally, the landlord will pass through the increases in operating expenses above the base year. What the tenant has to be careful of is what is defined as the base year. For instance, if your lease starts in December, you do not want the operating expenses to be the year your lease started, as you only had one month in that calendar year. Rather, you'd want to define the base year to be January 1st of the subsequent year.

A savvy Tenant Rep can help you negotiate even more favorable terms on the pass-through of operating expenses. Depending on the other terms of the deal, this is something you need to have a detailed analysis with your Tenant Rep. If you have any other questions, you could always contact us.

The typical expenses that have increases passed through to tenants are:

- Utilities

- Security

- Building Management

- Electric

- Water

- Trash Removal

- Security

- Landscaping

- Property Taxes

Understanding these major commercial escalation clauses helps you to know what to look for when signing a commercial real estate lease.

It is important to verify how certain calculations are done to avoid being ripped off. Make sure that the number that you come up with matches your new rent rate. Don't assume that the landlord has drafted things in your favor. If you discover a discrepancy, ask for clarification. Know that a Tenant Rep is an invaluable asset to ensure that your lease clauses benefit your budget.

You Could Owe More CAM at the End of the Year

In some cases with direct operating cost pass-through escalations, landlords calculate a budget for common area maintenance fees at the beginning of the year.

The fees are based on estimated costs and then divided among the tenants correlated to the square footage of the building that they occupy, respectively. At the end of the year, the landlord probably has the right to demand a payment from you to cover any shortages. On the flip side, you could receive a refund if you overpaid.

How to Control Base Costs

Control the rental agreement by ensuring that the contract contains clear and accurate definitions and language to control unfixed expenses and exclude unreasonable costs.

The rental agreement can achieve these objectives by providing a realistic base rent that does the following:

-

Excludes costs that are not reimbursable to the landlord

-

Adjusts bases and expenses to prevent unreasonable increases

-

Caps rent increases

The lease should also require the landlord to keep certain records pertaining to the expenses and give the tenant the right to audit those records. In most cases, the lease does not allow for a rent decrease.

Renegotiate Your Rent Escalation with a Tenant Rep

Remember to constantly assess your rental payments in relation to market value. Many landlords have their tenants on the hook for expensive, compounding escalation while market rent values plummet. If this is you, don't be shy. You have the power to renegotiate.

This is especially true for those who got hosed into signing an escalation according to the CPI. When it was low several years ago, it seemed like this would be a gamble that would surely pay off. But, the chances are, you're hurting now. This financial hemorrhaging will only continue as inflation grows by the day.

Backed by a Tenant Rep, you can approach your landlord to alter your current escalation clause. You can potentially reset your expensive rent to market value if you want to sign on for a longer term or take up more space. Thus, saving your company millions.

As Tenant Reps, we help our corporate clients navigate their commercial real estate (from rent escalation clauses and beyond). We have over three decades of market knowledge that empowers us to make the most optimal decisions for your CRE portfolio.

If you want to learn about rent escalation clauses, you're likely searching for a new lease. Luckily, we put together this course to make sure you are fully equipped to find the most optimal office space.

If you're curious about how a Tenant Rep could improve your rent escalation clause or streamline your portfolio, talk to a Tenant Rep yourself!