Unless you were lucky enough to negotiate a lease that remains fixed for its entire life, you will have to deal with the provisions of its escalation clause. This clause determines when your lease payments will go up and how much they will cost you. While escalations might seem far away when you first sign your lease, they will come into play eventually.

When Does it Escalate?

One of the first things that your lease escalation clause defines is when your lease payments will go up. Many leases in multi-tenant buildings have annual increases tied to the lease's anniversary date. If your rent payments started on March 1, you can expect them to go up on March 1 next year. Leases in single-tenant buildings might have escalations occur at three- or five- year intervals. The only way to be sure, though, is to read your lease.

How Does it Escalate?

Usually, your lease's escalation clause will specify one of these three types of increases:

-

Fixed increase. These increases are for a set dollar amount per foot (or for the entire space). For instance, your $35 per square foot lease might go up by 75 cents per year. Bear in mind that this could mean that the increase goes down on a percentage basis over time.

-

Percentage increase. In this structure, your rent escalates by a set percentage. So, if you have a $35 per square foot lease with 2 percent annual increases, it would go up to $35.70 in the next year, then $36.41 the year after that. These increases usually compound, which can add up over time.

-

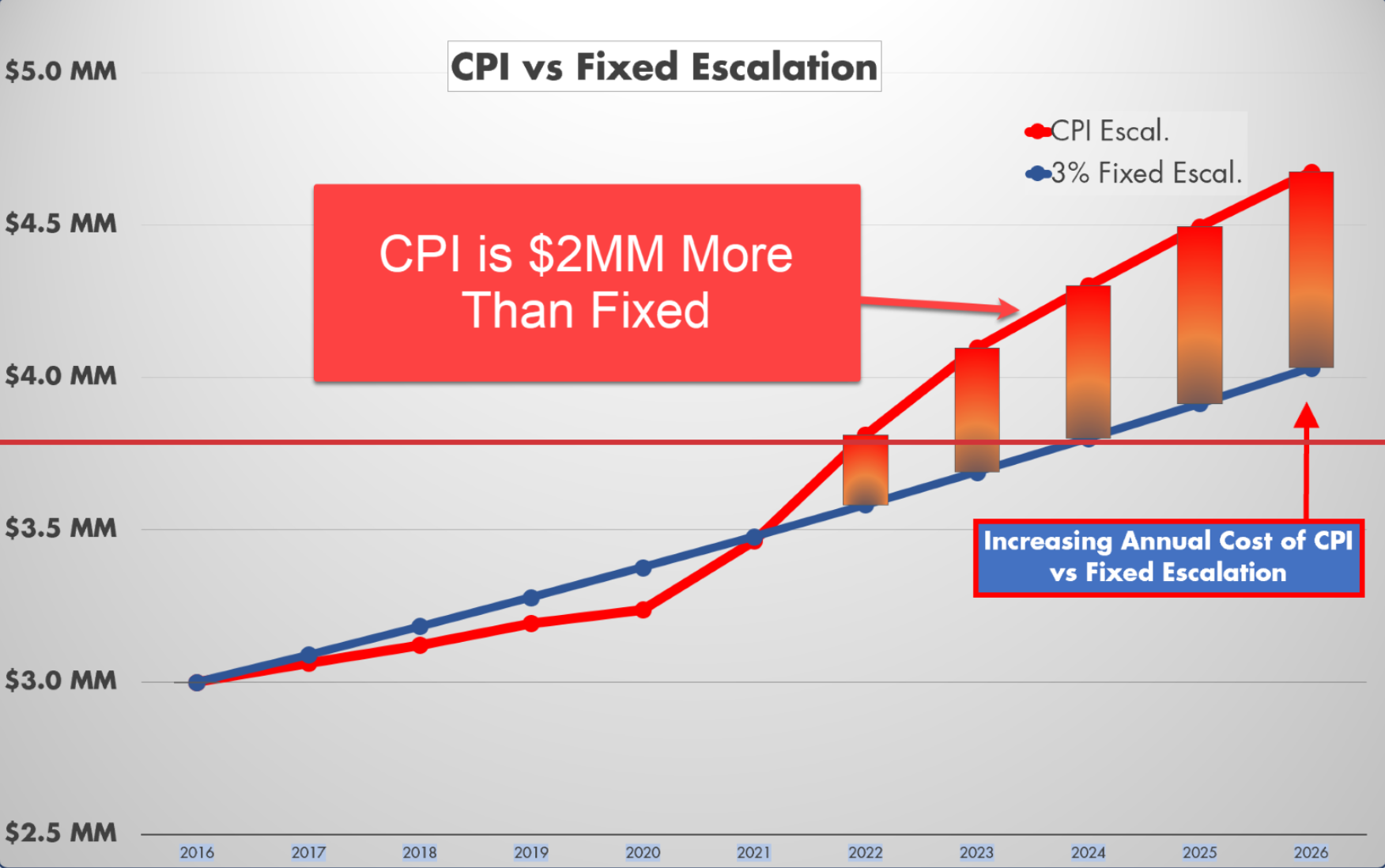

Consumer Price Index (CPI) or other inflation-based increase. When you have a CPI escalation clause, your rent will go up in sync with a pre-defined measure of inflation. If inflation is low, your escalation is small. But if inflation spikes, your rent could spike along with it. If you have this type of escalation in your lease, look carefully to see if there is a cap on how much it can go up in a year.

Expense Stops, Operating Expenses, CAMs, and Reconciliations

The escalation clause isn't the only thing that can make your rent go up. Many leases have mechanisms that make you responsible for some or all of the costs of running the building. While those costs can fluctuate in any direction, they usually go up. The triple-net lease where you pay all of your share of the building's expenses is the best example of this type of arrangement, but it isn't the only one. Read your lease carefully to see if you have these types of provisions in it.

Escalation Clause in a Renewal Option

Finally, take a careful look at the renewal options, if any, in your lease. Usually, they will specify some sort of method for resetting your rent. If you have fixed increases, they might continue in the option period. Other lease forms will reset the rent to 95 or 100 percent of fair market value for your suite. While your lease specifies the terms of the option, it's important to remember that the option doesn't stop you from negotiating a better deal. The option is what your landlord has to give you, but it doesn't limit what you can offer.

Here are a few other articles to check out:

What to Know About Rent Abatement

Why Should I Use a Tenant Rep Broker?

Multi-Tenant vs Single-Tenant Occupancy

Subscribe to our blog for more CRE tips!!