|

“Companies hiring tech workers across North America can expect to need 20% less space for a 500-person office than previous decades as layoffs and other cost cuts have joined remote and hybrid work of late as a bigger part of the industry norm. -CoStar |

Corporate office downsizing is nothing new. Right-sizing to cut footprints and costs has been the norm in the post-covid office market. But big tech, which used to be a heavy hitter driving up office demand, is now pulling back space at much higher rates than other industries.

Across the board, tech companies are taking on 20% less space than in the past. Compare this to other types of businesses, which have seen only a 6% decline in footprint size since pre-COVID.

Different expectations of efficient space utilization, evolution in workforce dynamics, including the rise of AI, layoffs and continuation of hybrid work models, have all stunted tech leasing. Let’s take a deeper look at why this is happening and how it may be a good thing for corporate tenants who do want to sign a new lease.

In the meantime, receive exclusive first access to the tenant's essential guide to surviving a post-pandemic office market.

Right-sizing and Smaller Tech Offices

Tech offices are increasingly opting for reduced space, reflecting a broader shift in how workplaces are utilized across industries. This more pragmatic approach to office space acquisition is driven by the need for efficiency and cost-effectiveness. Rather than fixating on expansive footprints, businesses are now prioritizing right-sizing their office requirements to align with actual needs, thereby optimizing operational efficiency.

|

“The decrease of expected office space reflects a broader change in how offices are being used in various industries." -CoStar |

Furthermore, with high interest rates and economic uncertainties looming, companies are feeling compelled to streamline their real estate holdings. By trimming down their office spaces, tech offices can lower operating expenses and hedge against financial uncertainties, bolstering their resilience in unpredictable economic climates.

This also means cutting into some of the extraneous features tech offices have been known to have from nap pods to game rooms.

Of course, cutting down goes hand-in-hand with maintaining hybrid work models.

|

“Working from home more than in the office remains the tech industry standard." -CoStar |

With remote collaboration becoming increasingly prevalent, the traditional notion of daily office attendance is evolving. In a hybrid work environment, there is a noticeable decrease in the number of people visiting the office on a daily basis. Collaborative tools have enabled teams to effectively communicate and collaborate from anywhere, reducing the need for constant physical presence in the office.

However, it's essential to note that the reduction in office personnel is not solely due to remote work arrangements. Layoffs within the tech industry have also played a significant role in diminishing office occupancy.

Big-Tech, Bigger Layoffs

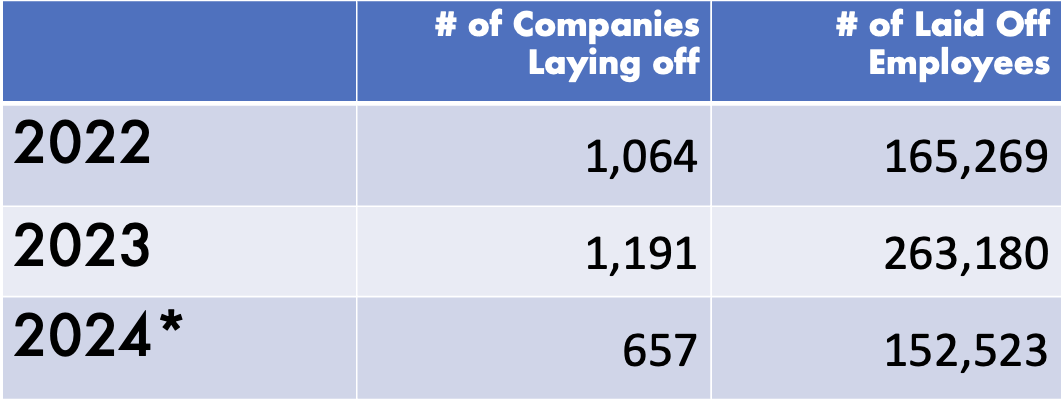

A wave of tech layoffs is rippling through the industry. Recently, multiple tech giants have implemented significant workforce reductions, adding to the strain on the office leasing market. Companies like Amazon, Meta, and Indeed have announced large-scale layoffs, exacerbating the trend of decreased office leasing.

*2024 is estimated based on YTD data, Source GlobeSt.

*2024 is estimated based on YTD data, Source GlobeSt.

This widespread downsizing within the tech sector has contributed to a sharp decline in demand for office space. With companies shedding employees and reassessing their real estate needs, the leasing volume of traditional offices have dwindled significantly.

This trend is particularly pronounced in tech-centric markets where companies previously drove substantial leasing activity. (Cough, cough, San Francisco. Anyone?)

According to Yahoo News, the tech sector in San Francisco is 60% behind its pre-COVID office capacity.

But as a whole, the recent wave of tech layoffs also reflects a recalibration from previous overzealous hiring phases within the industry. Between 2020 and 2022, the number of tech talent workers in the United States surged by 11.4%, representing an increase of 610,000 workers. This growth outpaced the nation's overall employment growth rate during the same period, which stood at 6.3%. Now, continued re-adjusting means a pullback in future tech hiring.

|

“In addition to those layoffs, the number of tech job postings also dwindled in the last year. The number of tech job postings was cut in half from a peak of 900,000 such postings in mid-2022 to 450,000 by early 2023” -CoStar |

And with the rise of AI, the tech industry is undergoing high-speed evolution, poised to slow hiring even more in the future.

The Rise of AI and Death of Coders

The tech industry, known for its high salaries, is particularly susceptible to AI-driven automation. With tech industry wages averaging about 16% higher than the United States average, the adoption of AI technologies could lead to further job losses and restructuring within the sector.

According to a report by Goldman Sachs economists, AI-powered automation has the potential to eliminate 18% of global jobs, totaling around 300 million positions.

Chief Executive Officer Arvind Krishna of IBM predicted that roughly one third of their in-office employees could be easily replaced by artificial intelligence. Out of their 26,000 non-customer facing roles, this means 7,800 jobs lost.

|

“I could easily see 30% of that getting replaced by AI and automation over a five-year period.” -Arvind Krishna of IBM |

And no matter what you think about the robot, white-collar revolution, this is a powerful, albeit drastic step to unlocking massive savings. The reality is that many tech professions will be phased out by generative AI.

CEO of NVIDIA, Jensen Huang predicted the death of the coding field and said, "It is our job to create computing technology such that nobody has to program. And that the programming language is human, everybody in the world is now a programmer. This is the miracle of artificial intelligence."

The global trend towards rightsizing will doubtlessly be amplified by the advent of artificial intelligence.

What This Means for Tenants

As the technological advancements of AI continue to reshape industries, commercial landlords now face the added pressure of adapting t o an evolving landscape that may further challenge their viability in the market.

Many businesses were already taking a cautious approach to their portfolio, attempting to both maximize the efficiency of their footprint while prioritizing long-term savings. And with giants like IBM now taking that same pause with their workforce until the full strength of AI is harnessed, others will take tangible steps to increase the role it plays.

However, with all this doom and gloom comes a sliver of hope for tenants. Despite the uncertainties surrounding the role of the workplace in a post-pandemic world, there is a notable interest among tech workers in returning to the office. This shifting perspective on in-person work presents an opportunity for tenants to capitalize on the current tenant-friendly market conditions.

“Those who believe in the power of in-person work stand to benefit from the current tenant-friendly market conditions, including the potential to sidestep substantial capital costs by leveraging the infrastructure and furnishings left by previous occupants.” GlobeSt

In the coming years, hundreds of millions of square feet of office space will hit the market, so for the prepared tenant, the perfect storm is brewing for the lease deal of a lifetime.

With record vacancies, commercial property owners have no choice but to be flexible with their tenants. So, if you plan to retain a physical office presence and are willing to sign on for a longer term, you may be able to renegotiate your space requirements and downsize to your current needs.

By embracing these changes and leveraging emerging trends, tenants can navigate the tech-driven landscape and position themselves for success in the future.

Luckily, we wrote the book on how tenants can survive the nuances of a post-pandemic office environment. Get your copy today.