Occupancy costs for leased offices, warehouses, retail shops and other types of commercial spaces account for a large share of any company's expenses. Having a clear picture of what it costs you to occupy your space is important for budgeting, and knowing how it may change over time allows you to create more accurate financial forecasts. A lot more goes into your costs beyond your base rent. Make sure not to overlook these common additional costs:

1. Rent Escalations

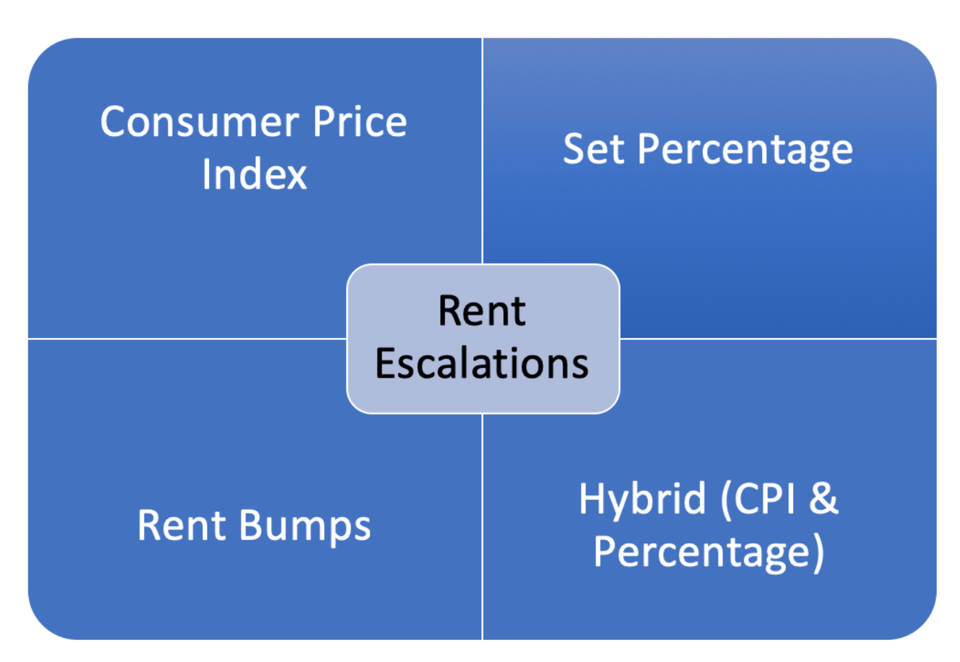

In most cases, rent doesn't stay level throughout the life of your lease, especially if you agreed to a long term. You likely will face a rent escalation at some point but when you can expect the costs to increase and how much it will change depends on the language of your lease. Landlords may structure escalations in any of the following ways, including:

- Fixed increases where your rent goes up a specific dollar amount at predetermined intervals. For example, your lease may specify that your rent will increase $1 per square foot each year.

- Percentage increases where your rent goes up by a specific percentage at predetermined intervals. This could mean a 2% increase per year or a sudden jump like 4% at the halfway point of a 7-year lease.

- Inflation-based increases where your rent changes in response to fluctuations in a third-party index.

Often, the consumer price index or CPI is used for this type of increase. During periods of steep inflation, your rent may rise dramatically. When negotiating a lease, it's important to get a cap that limits how much rent can increase.

2. Common Area Maintenance

Many leases require you to pay common area maintenance or CAM fees in addition to rent.

Depending on the type of lease and the terms it contains, your CAM may include:

- Property taxes

-

Insurance

-

Building repairs

-

Utilities

Your CAM is calculated based on the square footage of common areas in the building such as hallways, bathrooms and elevators. The landlord will assign you a load factor based on how much of the building you occupy to determine how much you need to pay for CAM.

3. Errors and Oversights

Errors and oversights can lead to unexpected and unnecessary increases in your operating costs. Some common places you may find errors include:

-

Calculation of usable square footage, the actual size of your office

-

Calculation of load factor

-

Calculation of what's owed for common area maintenance fees

-

Missing refunds when what you pay in CAM exceeds operating costs

When in doubt, have an architect measure square footage and run calculations yourself. You can request a CAM audit if you believe you have been overcharged or denied a refund you are owed.

4. Out-of-Pocket Tenant Improvement Costs

Often, landlords will agree to a tenant improvement allowance (TIA) to cover the costs associated with making a space ready for you to occupy. The tenant improvement allowance is usually a certain dollar amount per square foot, and it may not end up being enough to fully cover all the expenses related to tenant improvements. You'll have to pay the extra out of pocket, resulting in increased occupancy costs.

5. Fine Print Fees

Be on the lookout for additional fees included in your lease agreement. Sometimes, landlords charge property management and administrative fees separately from CAM. You may also have to pay separately for services like snow removal or landscaping.