First a pandemic, then a financial crisis, and now what?

Well, for corporate tenants it’s not all bad news. The CRE disruption of recent years has placed businesses in the perfect position to encounter savings in their second significant cost, their corporate real estate. So, what’s the most recent evolution in CRE negotiations? A shiny new Tenant Improvement Allowance.

Record vacancies are putting the pressure on landlords to pull in business- and the way they’re finding tenants is by getting a lot more generous with their concessions. Learn more about the Tenant Improvement Allowance and why you may be able to get a better offer for one now.

The Tenant Improvement Allowance

Tenant Improvements are pretty standard across the commercial real estate industry. Unless you’re taking on a turn-key lease (which is typically rare), some degree of renovation is expected. Obviously then, the level of necessary construction will depend upon the property’s state and whether it was previously inhabited by old tenants.

Across the board, cold dark shells will require more work and therefore will receive more funding from the landlord to get it to reach a workable state. Buildings need standard enhancements like lighting, floors, etc, and since you’re only temporarily occupying the landlord’s property, the onus to cover these costs should be on them. But, the tenant improvement allowance is usually a big point in negotiations.

Obviously, the tenant would like as much as they could get to customize the space, and while landlords want to make an appealing offer, they don’t want to get bent over the barrel paying for above-standard, company-specific enhancements. So traditionally, a Tenant Rep who negotiates on behalf of the tenant will demand that (at a bare minimum) the TIA should cover the expense of building out the space to be a warm vanilla shell- where there are appropriate fixtures for workable conditions (flooring, lighting, etc.).

Read more about Tenant Improvement allowance basics.

But now that we have a gauge for what’s kosher with the corporate tenant allowance, let’s get into how it’s evolving.

Office Landlords and Record Vacancies

CRE has undergone massive disruption. Still feeling the effects of the pandemic and now the indefinite ending of WFH, office vacancies are skyrocketing.

Not only this but, according to Bloomberg, leasing revenue has fallen 17% (and that’s only from the 30% of commercial tenants who have already approached the expiration date of pre-pandemic leases. So, this next wave (the 70% of tenants approaching renewal options) will be a doozy for landlords- and they know it.

As a result, they are getting more competitive to lure prospective tenants into their spaces. And the tenant improvement allowance, which was already in the spotlight for negotiations, is evolving to become a lot sweeter for corporate tenants.

According to Propmodo, “Before COVID, costs included in the tenant improvement allowance were fairly clear cut: structural improvements to the property that would benefit the landlord even after the tenant leaves, including the cost of construction labor, paint, new flooring installation, new electrical wiring, and so on. Soft cost expenses that aren’t associated with construction weren't typically included beyond a contingency estimate.”

In the past, landlords funding soft costs like furnishing and architectural costs were out of the question. However, CRE isn’t the same as it was in years past, and as a result, some degree of change is expected. As companies (not so gradually) shift away from their reliance on in-person collaboration, many offices are sitting empty. And the tenants who do want to return to regular meetings are holding their corporate spaces to higher standards. Traditional offices simply won’t cut it in this new world. New safety measures and premium features are absolutely necessary for modern offices.

So, landlords are becoming more flexible in negotiations to fund these standards (and more) for tenants who are looking for office space. Propmodo explains the rise in landlords covering soft costs, “New York City landlords started including furniture cost into the tenant improvement allowances just to get people in the building..."

|

"What was intended to be a short-term solution to assuage a transitory market started to become the norm.” |

Property owners observed that those who were offering to cover soft costs experienced a more expedited leasing process.

Let’s Talk Location

While this may look like a symptom of an already-wounded metropolitan market, it’s not. It’s no secret that traditional major hubs of industry (like NYC and San Francisco) have been suffering more since the pandemic. The cost of living going up while the quality of life simultaneously plummets, has driven away many people and businesses.

But what’s interesting is that property owners are experiencing comparable results in markets that have experienced post-pandemic growth. Hefty TIAs are not isolated to cities like Manhattan. They are popping up across the country- even in states along the sunbelt that have maintained more consistent growth and financial stability in the CRE marketplace.

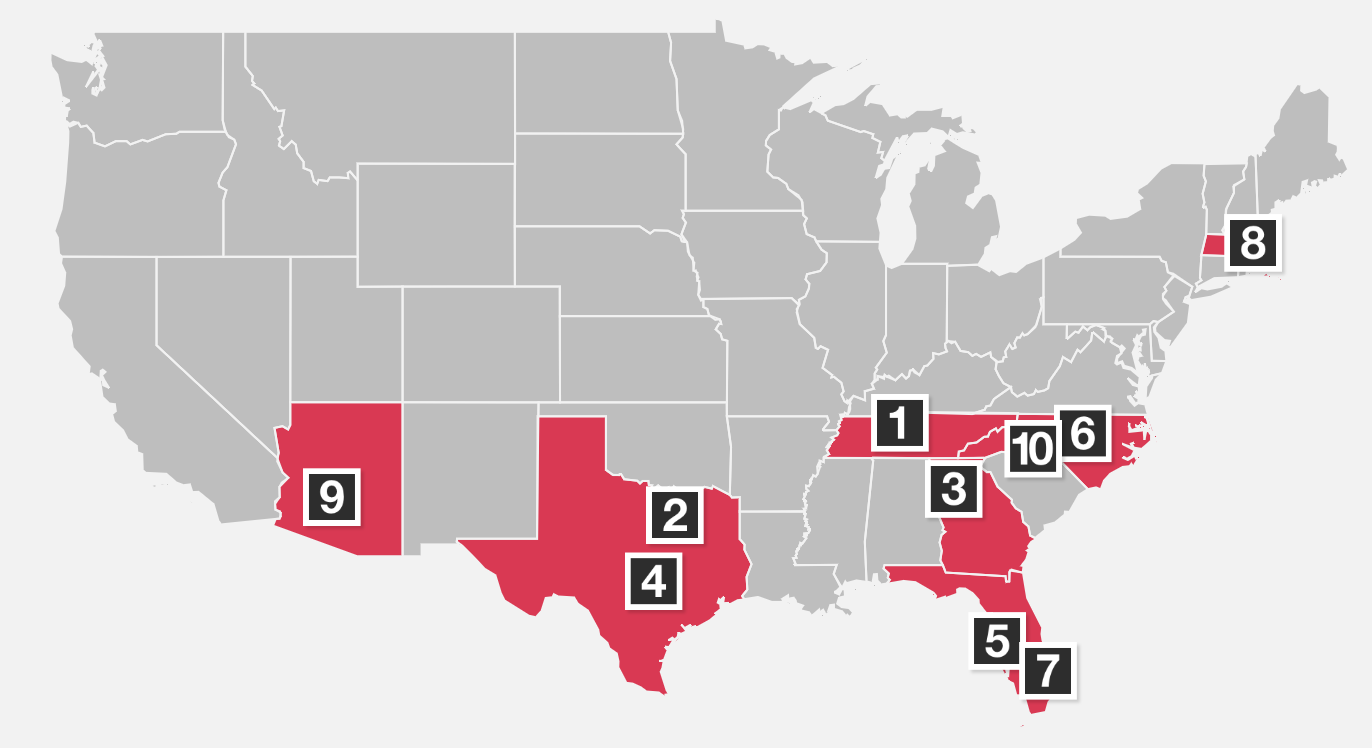

The top cities for real estate, according to Pwc, are ranked 1-10. The states with the top cities are highly concentrated along the nation's sunbelt.

The top cities for real estate, according to Pwc, are ranked 1-10. The states with the top cities are highly concentrated along the nation's sunbelt.

Learn the Top 5 Cities for Corporate Real Estate.

Across the board, sunbelt states like Texas, Florida, and Tennessee are benefitting from “the new normal” from the pandemic. Experiencing massive immigration from Americans fed up with the high cost of northern metropolitan areas, the sunbelt grew in prominence while the rest of the country struggled. One would think then that with so many Fortune 1000 companies flying south to scoop up prime commercial real estate, that Southern landlords wouldn’t feel the pressure to offer such impressive concessions. However, “average tenant improvement allowances across the sunbelt office market are up 16.2% from the end of 2019 to the second quarter of 2022. By comparison, work values are up 30.6% in a market like New York City or 31% in the California Bay Area.”

Significant increases to TIAs are sustained across the nation, with no end in sight. Even in areas where job and population growth have returned to or exceeded pre-pandemic levels, landlords are bending further in negotiations. This indicates how much evolution has taken place in the nuanced relationships between corporate tenants and property owners. Offices are being held to higher standards across the board. And since WFH is an ever-present option, many tenants don’t want to foot the bill for an expensive redesign. Landlords are then left with empty space, unless they invent modern solutions to contemporary issues. And in this case, the solution to empty space is making tenants offers they can’t refuse.

What Do Elevated TIA's Mean for You?

Well first off, if you’re looking for new space you can keep this information in the back of your pocket. Use the ever-growing TIA standard as a negotiating chip. If one landlord doesn’t want to offer you a premium for your tenancy, another will. A higher TIA gives you a lot of freedom to upgrade the design of your space. You are able to experiment with non-traditional and social distance-friendly seating options. Or, you can equip the space with premium amenities.

However, this negotiation tool is not only accessible to new tenants. If you are several years into a lease, you have the potential to renegotiate the existing terms and clauses. Your landlord may be willing to offer you more tenant improvement dollars if you sign on for a longer period. Your tenancy represents guaranteed income... so they may be willing to sweeten your deal if you extend your stay.

Get the Optimal Tenant Improvement Allowance with a Tenant Rep

As true Tenant Reps at iOptimize Realty®, we help corporate tenants maximize the value of their tenancy by employing 30+ years of market knowledge and skillful negotiation. We have seen how tenants can save millions by renegotiating their leases. You may be in the right position to rest your rent to market value or earn an extra chunk of change to upgrade your offices. So, don’t waste any more time.

Talk to a true Tenant Rep who can save you up to 33% of your CRE costs and 95% of your CRE time.