Your commercial property’s operating expenses can be one of the most significant expenses in your lease. To manage the net value of your lease, it is critical to understand how operating expenses influence the tenant’s overall budget.

How do we know this? As tenant reps, we have spent over three decades helping our corporate clients achieve leases that benefit them. We have seen how big a role operating expenses play in solidifying a lease that is in the tenant's best financial interest. We have included our CRE market knowledge in this article so you can make the most financially sound decisions for your organization.

So, if you want to negotiate the best possible operating expense terms, read on. We have included our CRE market knowledge in this article so you can make the most financially sound decisions for your organization.

To prepare you to negotiate an operating expense package that works for your budget, we will go through:

- What your operating expenses cover

- How operating expenses appear in your lease

- The landlord’s contribution to operating expenses

1. What Your Operating Expenses Go Towards

Operating expenses (OpEx) fund the building’s support and maintenance capabilities. Without these systems, your property would be uninhabitable. Your rent payments for operating expenses are usually devoted to:

- Property maintenance (including real estate and other taxes, janitorial services, repairs insurance, and utilities)

- Reimbursement for the landlord’s investment, resources, time, etc.

Know that basic operating expenses will depend on many factors and can differ by the landlord. One specific consideration is regional variations. The typical OpEx of properties is often contingent on their geography. For instance, what it takes to get a Manhattan office up and running may differ from the requirements for commercial offices in middle America.

Regardless, your lease should include a detailed outline of what your operating expenses will cover. If not, you may find yourself responsible for additional charges you hadn’t planned on paying. Therefore, you not only want to specify what you’re responsible for financially but also what should not be included in your budget.

Often, a lease negotiated in favor of the tenant, will include specific exclusions. The tenant cannot be made responsible for these charges by being lumped into the operating expenses.

Some standard exclusions tenants should be aware of are:

1. Capital expenditures or equipment2. Advertising or promotional costs for the building

3. Accounting/ legal/ compliance fees (unless they affect all tenants equally)

4. Costs associated with operating the business of the landlord

5. The landlord’s cost of working with other tenants

The exclusion you should perhaps be most aware of is for capital expenditures (CapEx). These refer to capital equipment purchases or owned assets of the landlord. Since you are leasing it, your stay is temporary (even if it's for 10+) years. Therefore, your budget should not reflect additions to the building that will exist after you leave. However, fixtures with a functional shelf-life less than matching the length of your term may fall in your tenant improvement allowance.

2. How Operating Expenses Appear

Your responsibility to cover operating expenses directly will depend on your lease type. Typically, office spaces will be presented with full service/ gross leases. These names denote the same thing: an agreement where the tenant pays a base rent rate that includes all additional charges. The landlord includes expenditures like operating expenses in a lump sum and then deals with vendors directly.

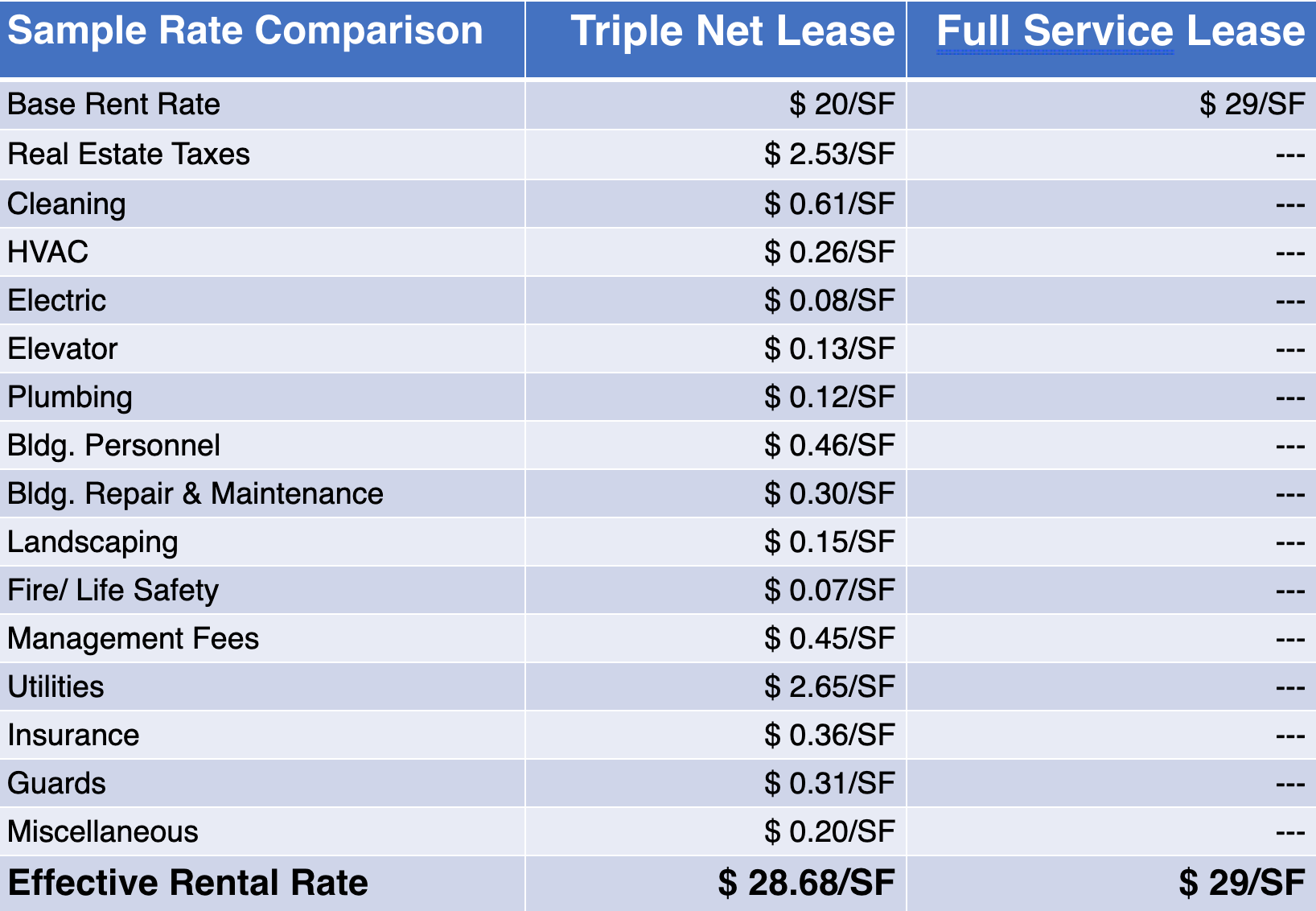

This is opposed to triple net leases, the other most common lease type. However, triple nets are usually associated with warehouse space or build-to-suit properties where one tenant inhabits the entire premises. With this agreement, the tenant pays a lower initial base rent to the landlord because they pay for any other expenses directly.

Sample rate comparison of triple net and full-service leases. In this case, the tenants would essentially be paying the same total amount but with the full-service lease, the base rent accounts for all external payments.

Sample rate comparison of triple net and full-service leases. In this case, the tenants would essentially be paying the same total amount but with the full-service lease, the base rent accounts for all external payments.

3. Your Landlord's Contribution

Depending on your lease and term, your landlord may pay for a portion of the operating expenses. This is how their contribution would appear:

Expense Stop

With full-service leases, the landlord may agree to cover some operating expense costs. Their fixed contribution is known as the expense stop. It is the landlord’s maximum contribution specified in a dollar amount of the base rent. The tenant is responsible for all costs over this amount.

Their expense stop can account for all of the operating expenses as a package or place individual max contributions on each. Their contribution will usually remain steady over the term of your lease. Once they have you on the hook, they are unlikely to be willing to readjust the amount.

Base Year Approach

The expense stop will typically be quantified by utilizing a base year’s expenses. In this case, the landlord and tenant will agree on a base year to determine the baseline amount the landlord is responsible for. If the tenant exceeds this amount in future years, the tenant will cover the difference. Conversely, if the amount is below the initial year’s charges, the tenant may be entitled to a credit.

As an example, let’s say that your landlord spends $20 per square foot on OpEx in the base year. If the expenses total $21 per square foot in a subsequent year, the $1 per square foot amount over the expense stop will be “passed through” to the tenant.

Utilizing a base year approach can put some tenants in hot water. Parties that should be hyper-aware of this possibility are the initial tenants in a new multi-tenant building. This is especially true considering tenants in multi-tenant buildings usually pay a pro-rata share of the operating expenses. Accordingly, they pay a share of the property’s total expenditures that correlates to their square footage.

How does this get tricky? Well, when the building’s total operating expenses are determined by the use of one or two tenants, the overall price will be much lower than a fully occupied building. Therefore, using the first year as a base year estimate will not accurately measure the total costs for years to come. (And your landlord can get off the hook for more costs).

It is also notable that it could take years for a building to reach 75% capacity. That is why a base year determined, even in the first several years, may not be feasible. To receive the most accurate and fair expense stop, ensure that the base year is not selected until the building reaches at least 90-95% capacity. That way, your share of the charges can be assessed most precisely.

If not, your landlord may attempt to introduce a gross-up that allows them to estimate the expenses of a full building. However, complications usually arise as the expense increases can usually not be determined by a simple percent increase.

Why Operating Expenses are So Important

Eventually, OpEx charges could take up 40% off your lease’s net value with escalations. They are an extremely significant cost, so properly negotiating them is critical.

If you still feel overwhelmed after reading this article, you can always work with a tenant rep. Tenant reps can leverage the value of your tenancy to ensure that your lease clauses are beneficial. Conversely, poorly negotiated clauses can cause major strains on your real estate budget, negatively affecting your bottom line.

To avoid this from happening to you, learn how a poorly negotiated clause can cause financial complications for the tenant.

At iOptimize Realty®, we are real estate experts, who have provided guidance on hundreds of leases. As a result, we know how to ensure our corporate tenants receive the best deal for their operating expenses. We also are aware of all the rights and options you have that will save you money and time. So if you’re ready to work with a tenant rep, or want to learn more contact us!