If your current lease is up or you’re looking ahead to see what the market has to offer, there are many variables you must pin down.

How long do you want to be in your next space? Do you know the geographic area of your preferred building? Are you prepared to spend extra money on possible renovations to the property you move into? What are you prepared to lay down as an initial investment?

Depending on your answers to these questions, you can determine whether leasing or buying a space is a wise move for your organization.

We are tenant representatives, experts in the real estate field who have a history of helping clients determine the most optimal decisions for their corporate real estate portfolio.

If you are curious about whether you should lease your next space, this article is for you. We have included our expertise so you can make more informed decisions for your CRE.

In outlining the pros and cons of leasing a space, you will better understand if it is the right move for your organization.

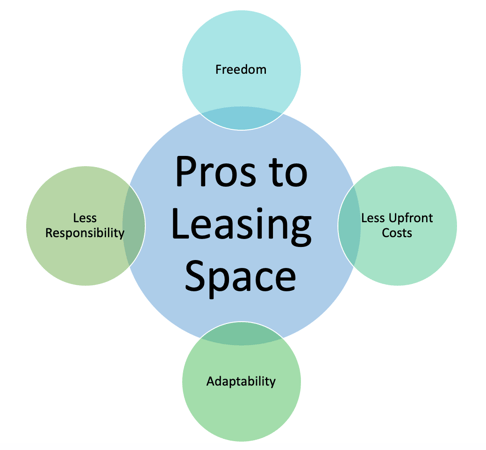

Pros To Leasing Your Commercial Property

Leasing your property offers your organization many benefits. Let's go through them.

Freedom

Perhaps the most significant benefit of leasing space is the flexibility it will give your organization. Your company’s performance does not exist in a void. It is greatly influenced by the ever-changing marketplace. Adapting to the shifts in consumer demand and other moveable factors will allow your company to stand out against the rest.

Leasing gives you the freedom to do this.

When you tie yourself to property ownership, you sign on for a twenty to thirty-year mortgage. Unless you are confident that your company could not only survive, but thrive under this circumstance, it is better to consider leasing.

Leasing a space gives you many opportunities to adapt to both internal and external influences. You have more options that you can control. Are you not ready for a ten-year lease? Well, you have alternatives. Depending on your needs, you can sign on for 12, 60, 91-month leases, etc. Are you concerned that there may not be enough stability in a shorter lease? Then you can lay down your company’s roots with a lengthier term.

Not sure if you want to be in your lease long term? Sign a shorter term with options to extend if you still need the space.

Adaptability

You also have room to grow or shrink your organization if need be. Think about the current work from home movement. Many organizations are capitalizing on the office exodus. None of this could have been predicted even five years ago. You could be vulnerable to disrupter events like this if you own a property.

Buying a space may mean that in the future, you could miss out on cheap, efficient, and unforeseen alternatives to existing notions of work.

Leasing also gives you the freedom to adapt to geographic shifts in the market. Buying a property means that at least a significant portion of your organization is stuck in that specific spot. You could be throwing away opportunities to save in other parts of the country that may become more business-friendly as time goes on.

Overall, the freedom associated with leasing a space could be considered invaluable. It is also why many organizations forego property ownership.

Less Responsibility

Depending on your lease type, as a tenant, you will have different responsibilities for upkeep, maintenance, and operational costs. However for the most part, the landlord takes care of most of these factors.

When you are a tenant within a property, you have more time and energy to devote to your organization's needs. If you were to buy your next commercial space, then you take on all of the responsibilities associated with owning and overseeing a building. As you can imagine, this could quickly become overwhelming.

You also don’t need to deal directly with the bank or other debt services. Therefore, if there is a disaster, you have more freedom to move. However, landlords would still be stuck with monthly payments, but no tenants to fund them! If you own your space, you will be the one on the hook for these payments.

The minimal responsibility associated with leasing a space could prove vital to the success of your organization and its ability to adapt to unforeseen circumstances.

Low Upfront Cost

If you want to spread your payments over your term, leasing is definitely for you. Buying a property often requires a substantial down payment. In many transactions, nearly a quarter of the property’s entire cost is expected upfront. For a multimillion-dollar purchase, this is a huge chunk of change to lay down as an initial investment.

If your organization is not prepared to lay this down, then leasing is for you. Companies looking to buy a space should have crystal clear projections for their company’s growth. If not, they risk being in the hole for a property they shouldn’t have bought.

It may make more financial sense to lease your space rather than fork over such a large amount of money.

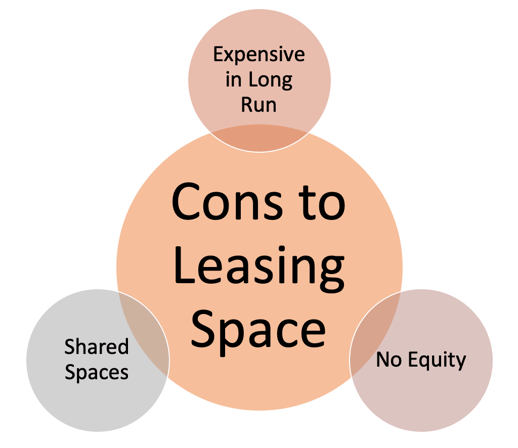

Cons to Leasing Your Property:

Leasing your next commercial space could also be associated with some drawbacks. Let's go through them now so you won't be surprised later.

Expensive in the Long Run

Depending on the needs and actions of your organization, it may actually be cheaper to buy a property in the long run. When you become the owner of a space, you pay fixed-rate mortgage payments (in addition to the initial down payment).

On the other hand, you are subject to rental escalations when leasing space. As your landlord increases the cost of your rent throughout the length of your term, these elevations could quickly add up. This is especially true if you sign on for a longer leasing term. Each elevation will build on the last, and you may be stuck with rent that greatly exceeds the market value for a property like yours.

Owning a building also gives you opportunities for extra income. You can lease out space within your facility to other tenants. Through their rent payments, you could essentially be occupying your building rent-free. Even better, you could stand to make a profit from your tenant’s rent payments. Buying your next space could be a clever step to reducing your company’s overhead costs and increasing your bottom line.

No Equity

When you lease a space, you are a guest paying rent. You have no ownership in the property. Therefore any money you pay to renovate your space directly benefits the landlord. Any tenant improvements you make to the space during your leasing term increase the value of the building. Therefore, the landlord can ask for a higher asking price for the space that you paid to fix when you leave.

You also generally have less say in what goes on in the building. As the landlord takes care of most of the operational factors, you may find that the building is not run to your liking. You are also subject to the landlord’s chain of command. Any changes you wish to make have to be run by their authority. Build-outs you want require the landlord’s green light.

Shared Spaces

You may also have to deal with other tenants. Depending on the terms of your lease, your landlord has the potential to move in other companies into neighboring spaces.

Often tenants are given a say in the other organizations that may move in, but this is not always the case. As a result, you may find yourself within the same property as a potential competitor.

No ownership also means that you may be faced with the inconvenience of re-laying down your company’s roots every time a lease is up. The time, money, and energy you spent transforming a space into one that can foster your company’s growth will eventually be all for loss. It may offer your organization more stability to buy and remain in a property for the foreseeable future.

Where to go From Here?

Well- what do you think? Is leasing a space right for your organization? Or are you ready to start considering property ownership instead? There is no right answer. It all comes down to what would work best for your company and its specific needs.

Either way, tenant representatives can help you in whatever real estate decision you choose. They can even help you at the starting point to make the decision that can most benefit your CRE portfolio. Their representation can prove vital to defining terms, negotiating with landlords, and securing you the overall most optimal deal.

Looking to learn more about tenant reps? Check out this article!