For a growing business, renting an office space can be a huge expense. The hidden charges and the clauses in the lease agreement can also make getting the office space unnecessarily expensive. Commercial real estate lease documents typically contain detailed rental escalation clauses that show how increases in rent will occur. Rental escalation clauses are designed to help landlords mitigate price increases in maintaining the office building.

Here are 5 things you should know about them:

1. Stepped Increases

This form of rent escalation allows the landlord to gradually increase the rent on your commercial property over a certain period of time. For this type of rent escalation clause, the square footage of the commercial building is used to determine the rate increases.

2. Pass-Through Escalation

This type of rent escalation clause is triggered by an increase in the property tax of the landlord. When this particular type of rental escalation s triggered, you receive an increase in your monthly rent based on the percentage of the building you occupy. Compared to the other forms of escalation, this is the most favorable for the corporate tenant.

3. Direct Operating Cost Pass-Through Escalation

As the year rolls by, direct costs such as maintenance, utilities and security increase.

The direct operating cost pass-through escalation clauses shows what happens when direct costs increase during your commercial lease period.

This rental escalation is based on the amount of the building that you occupy and is also by how your commercial lease is structured.

When negotiating your lease, it is important that you know who is responsible for the direct costs and who is affected when the price rises.

4. Renewal Option Escalations

Although commercial real estate leases are usually long-term leases, you may have to adjust the rent of your building especially if your lease term ends in your triple net commercial lease. Usually, the landlord will provide a method for resetting your rent. This escalation clause is open to negotiation, and you can use this escalation to ask for a rental deal that is suitable for your business as part of your new lease terms.

For instance, you can have a single large increase, or you can reprise the rent to some fraction of the fair market value. In other cases, you can continue with the lease terms.

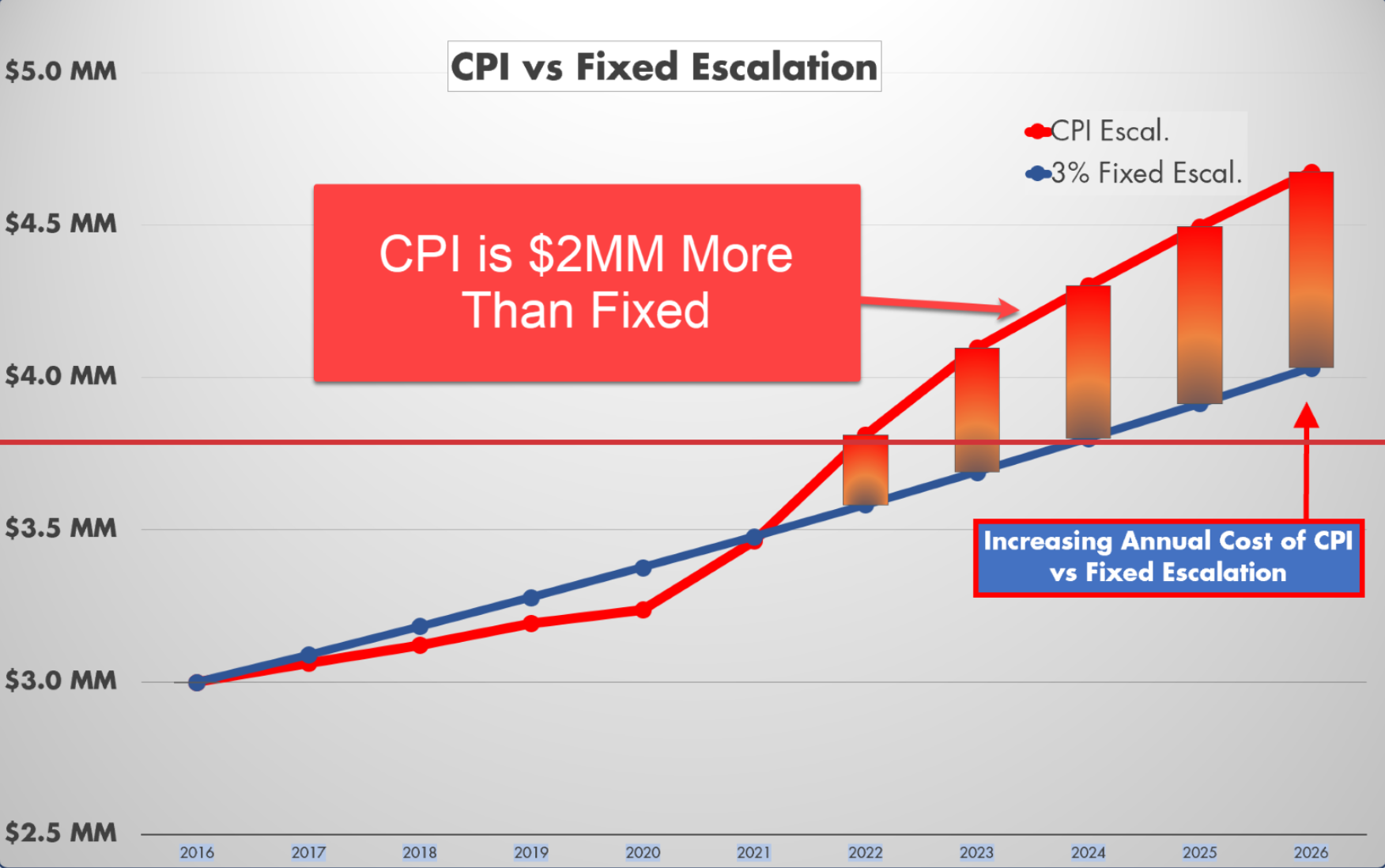

5. CPI Based Escalation

This is popular among landlords because this escalation clause allows for variable adjustments over the period of a lease. With this type of rental escalation, your rent rate increases when an established index (such as Variable Consumer Price Index) rises. Often, the index used is the Consumer Price Index. Under indexed escalations, if inflation is 1%, your rent increases by 1%.

The unpredictability nature of the CPI makes this type of escalation less favorable for tenants. To avoid an unanticipated spike in inflation, the lease may be structured with a cap. For instance, the lease may say that it will rise according to the CPI or 5 percent per year—whichever is less. The Consumer Price Index released by the U.S. Bureau of Labor Statistics.

Here are a few other articles you might enjoy:

What is Tenant Representation?

What is Rent Abatement & What You Should Know

Subscribe to our blog for more CRE articles!!