There is no way to reach your company's optimal performance without the right real estate. It is typically an organization’s second or third most significant cost, so mistakes are expensive….really expensive.

Real estate expenses affect your company’s entire overhead. So, don’t you wish you knew the most common mistakes companies make with their portfolios, so you know what to look out for?

You’re in luck. We are tenant reps, real estate professionals who have spent over three decades protecting the interests of corporate tenants. We have seen the areas where our clients struggle and the most common errors to avoid.

In this list, we have included the most common mistakes and also methods that promise improved efficiency and price.

1. Not Knowing What Lease Terms to Look For

When managing your CRE portfolio, knowing your rights as a tenant and how to exercise them is of the utmost importance. If certain clauses are not outlined in your original lease, you cannot put them into action.

For example, if you wish to sublease a portion of your space but you did not consider this possibility when your original lease was finalized, you have no power to sublease now. You should also be aware of information that dictates the amount of your tenant improvement dollars, operating expenses, and access to amenities.

One of the biggest mistakes tenants make when negotiating lease terms on their own is not knowing what to look for. Since landlords’ legal teams and brokers draw up leases, they are written to benefit them. Often, things can go missing between the lines. It takes an informed real estate professional to identify where there is room to improve not only the listed terms, but also when clauses are lost in omission.

2. Using a Conflicted Broker

It is key to work with representation to ensure that your rights are protected. As discussed, landlords are often equipped with representative teams. If you go into negotiations alone, you may find that you will be outmatched in terms of real estate savvy.

However, when looking for representation, watch out for firms that work with both tenants and landlords. When your rep is connected to a property through the landlord, they will have less incentive to negotiate down costs.

This conflicted rep most likely wants to maintain their relationship with the landlord. Unfortunately for you, this also means they will attempt to fill vacant properties as quickly as possible. As a result, if you are looking for commercial space, they may match you with buildings that do not entirely meet your needs just to get a tenant in the property. This quick negotiation process also may cause you to miss out on specific terms, features, and perks.

Ensure that your best interests are fully protected by working with a firm that only serves tenants. If you work with a conflicted broker, you could be missing out on the best properties, features, and lowest prices.

3. Losing Track of Your Space Utilization

If you haven’t assessed your space utilization lately, it may be time to do so now. The spatial needs of an organization change with time. Your current square footage may not be the most optimal amount. Tracking the utilization for each property will identify areas where you are under or over-utilizing your square footage.

Many businesses are now realizing how quickly their demand for physical working spaces has shifted. The work from home movement has left many offices empty or operating at severely reduced capacity. This wasted space is a significant drain on your organization's budget.

Once you recognize your company’s potential for wasted space, you can close in on it. Depending on your existing lease, you have many options to mitigate the negative effects of unused space. If you have a sublease clause, you can rent out un-utilized space within your property to other tenants. If your lease is almost up, you can relocate to a building that matches your optimal square footage. You are not limited to these possibilities, and working with a professional may help you set what option may work best for you.

Who Can Benefit From Tracking Utilization?

Any organization can benefit from measuring its utilization. However, companies with larger footprints have a greater potential for wasted space. For example, let’s say that in one property, you find that you don’t need 5,000 feet that you are paying for. You are underutilizing your space so that is 5,000 feet essentially going unused. However, you don’t have just one property. You have twenty-five where this situation is roughly the same.

So you aren’t just wasting 5,000 square feet, you are paying for 125,000 square feet of unused space. In New York City, where the going rental rate of Class A buildings is about $70 per square foot, this wasted space will cost you $8.75 Million!

4. Limited Geographic Mindset

Many businesses are getting creative with their locations. They find that moving from expensive, business-unfriendly areas is slashing their overhead costs while increasing their quality of life and work.

Popular destinations for relocation are located along the nation’s Sunbelt, specifically Florida and Texas. These states have drastically reduced gas prices, tax rates, payroll, and rent costs. As a result, top industrial players have shifted their headquarters or satellite locations to the aforementioned areas.

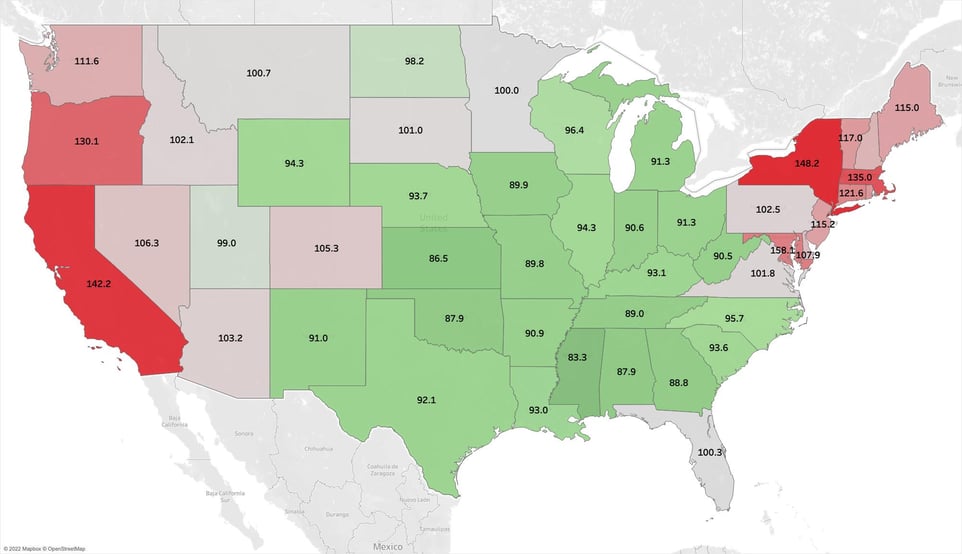

(Cost of Living Across the Continental US where National Average is 100)

For example, Tesla and Oracle have spearheaded the corporate migration to Texas. At the same time, over 300 financial players, including Goldman Sachs, have moved to Southern Florida.

Those who have the most to gain from a geographic reorientation are located in California and New York, where overhead costs are bleeding your budget dry.

Overall, if you are aware of the nation’s marketplace, you will know if you are getting a good deal or not with your current space. You don’t have to move across the country to benefit from relocating. However, if your term is almost up, you should begin looking to areas where relocating will benefit your organization’s success.

5. Losing Track of Important Dates

There are specific key dates outlined in your lease that you should be aware of. Missing them is a common way tenants can fall into a real estate nightmare.

If you aren't keeping track, the right to exercise your options, renew your lease, anniversaries when rent increases, etc. can quickly sneak up on you. Sometimes these terms will renew automatically, so if you miss the window of cancellation, you’ll be stuck paying for space you didn’t want.

Conversely, if you don’t reach out by a certain date, you may lose options or rights of renewal. So when keeping these days in mind, you want to give your organization enough time to meet internally and determine the best real estate moves.

It is advised that you begin exploring your options six months to 2 years before the end dates. This will allow you time to fully consider where your property is concerning the market and your own company’s needs. In addition, being generous with your time will allow you to conduct the appropriate due diligence to pinpoint where there is room to improve on one location or an entire portfolio.

Avoiding the Most Common Mistakes

Mistakes are expensive, but unfortunately, they happen. The good thing about them though is that we can learn from them. So, take this list as a point of future consideration when managing your CRE portfolio. Being aware of the most common errors will help you avoid falling into them.

If you want help managing your portfolio, you are not alone. Tenant reps can help you simplify the real estate process while securing you the most optimal prices and properties.

Looking to learn more about using a tenant rep? Check out this article!