People and businesses are leaving metropolitan areas in record numbers. Now, this shouldn’t come as a surprise because it really isn’t anything new. Given the workplace flexibility of the last few years, Americans have realized that they can get a better quality of life for cheaper outside of the nation’s cities. However, what is newly developing is the negative cyclical affect this is having on what used to be the country’s most powerful financial centers.

Learn about “The Office Apocalypse”, where low demand for office is evolving, and how tenants can take advantage of this unprecedented time.

The Move Out of America's Cities

Manhattan has been hit hard in recent years. The urban powerhouse’s success was highly intermingled with the massive commuting workforce and the offices they occupied. However, since those offices have become (at the very least) semi-mandatory, the whole system is toppling on its head.

According to the Commercial Observer, vacancy rates in top markets are higher than ever, "The effect of companies shrinking or decamping to cheaper areas has reverberated throughout the New York City office market...Office vacancies in Manhattan reached 16 percent, its highest level in two decades, in the second quarter of 2022.”

To read more about whether a NYC office is worth the cost, check out: The Pros and Cons of Locating Your Business in Manhattan.

But it’s not only Manhattan feeling the hurt. Other extremely popular cities are experiencing similar fates. For example, the tech- mecca San Francisco has office-vacancy rates of 34% to 40% throughout the city.

|

From January 2020 to May 2022, US cities have lost 17% of their leasing revenue, an estimated $453 billion (about $1,400 per person in the US) in real-estate value. |

As less emphasis is placed on office attendance, employees previously tied to their work radius have been moving predominantly to the suburbs. Businesses looking for in-person collaboration have been gradually following the emigration out of cities. They are finding what Americans have, but on a corporate scale: That there is more work/life flexibility without commuting to cities, and newfound freedom from city expenses.

As a result, suburban office demand has experienced boosts where CBDs have been consistently lacking.

The Commercial Observer found that, “Law and finance firms are increasingly moving to the suburbs of Connecticut, New Jersey, and Long Island, both to serve remote workers and to save money on pricey Manhattan office space. That correlated with a 3X increase in people moving from New York City to the tri-state area’s suburbs over the course of 2020 and 2021."

If you are looking for office space in the suburbs, now's your chance. But, there's no time to waste and certain things you don't want to get wrong. Learn how to find your best office space in the free course below.

Office Demand Down Throughout the Country

Even though the suburban office sector has its head above water for now, the numbers are still far below pre-pandemic norms. While cities are suffering tougher blows, overall demand for commercial offices across the county has significantly dipped.

According to a study titled “The Office Real Estate Apocalypse”, from the beginning of the pandemic to May 2022, leasing revenue has fallen by 17%. While this already sounds bleak, it only tells a part of the story. Only about 30% of tenants have had to assess a commercial lease renewal.

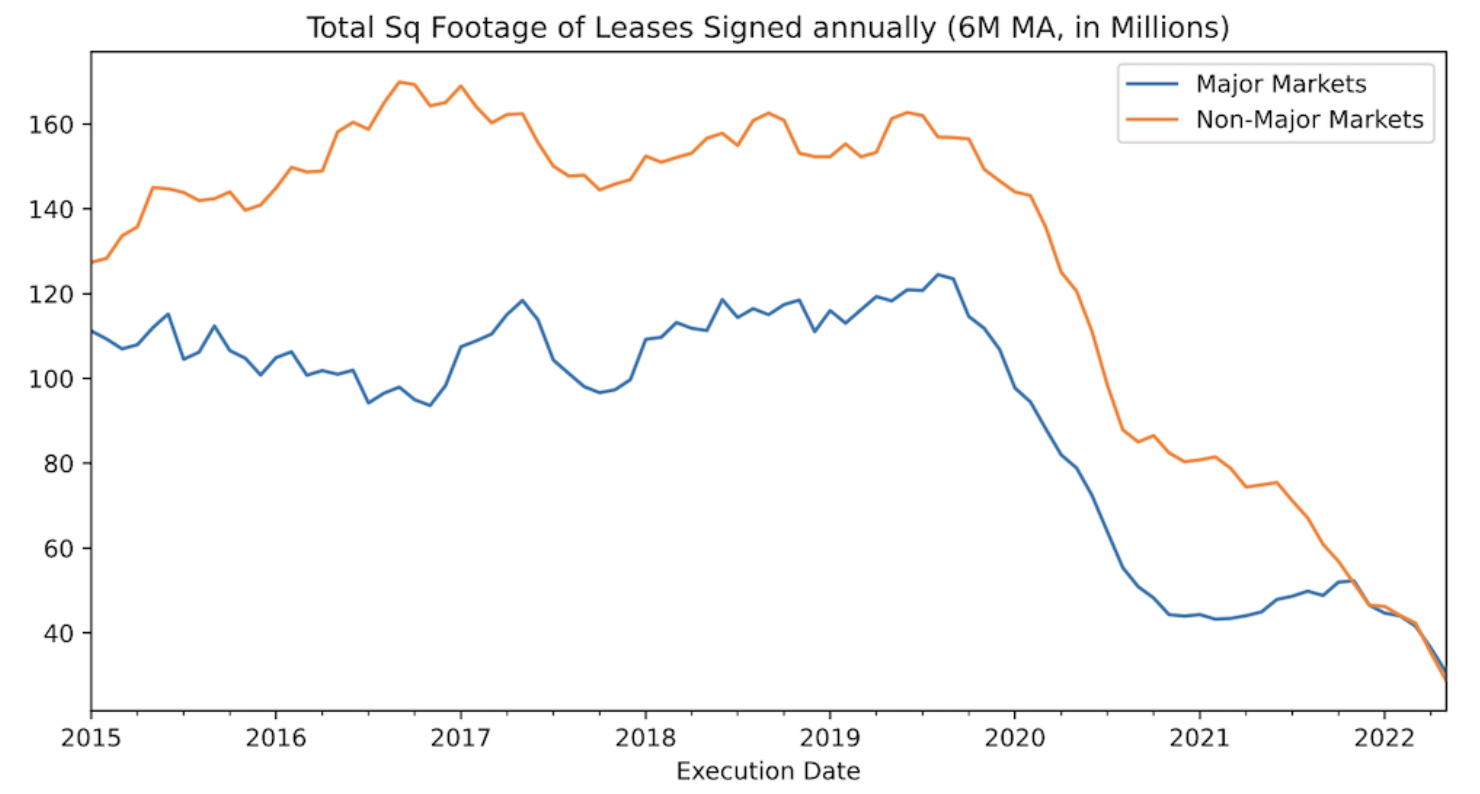

Data Source from the study "Work from Home and the Office Real Estate Apocalypse"

Data Source from the study "Work from Home and the Office Real Estate Apocalypse"

“That means that there’s 70% more tenants that are still sitting on their pre-pandemic leases that are yet to decide whether to renew that lease." explained Stijn Van Nieuwerburg, of Columbia Business School and chief researcher on the study.

If you're a coming up on your lease renewal, now is your time to start thinking about your options. Unfortunately, many corporate tenants are not reaping the full value of their business. Learn how to get your best lease renewal.

Because, this next wave of corporate tenants approaching renewals is sure to be cataclysmic to property owners who have already been struggling to cope with the economic circumstances at play. Low demand for office space coupled with skyrocketing interest rates have devalued the investment in the CRE asset class. In New York alone, the value of commercial real estate has been estimated to dip almost 40% from pre-pandemic standards.

|

“Before the pandemic, 95% of offices were occupied. Today that number is closer to 47%.”- Business Insider |

This means that even if property owners find the perfect, credit-worthy tenant who wants to expand their footprint, property owners must significantly reduce their profit margin to get competitive enough to lure them in.

As a result, it's been suggested that corporate building owners shift their focus and transform their vacant properties into something people want: Housing.

According to Business Insider “Empty offices can become apartments to ease housing pressure while also bringing more people back to downtown areas.”

This is especially important in cities because while there are fewer office leases in general, CBDs have been hit the hardest- and the pain is reverberating through multiple industries. Since less office workers populate metro areas, there are less consumer dollars being put back into communities. Less tax dollars and financial activity can perpetuate a cycle in which deferred public interest makes a location less of a target for government support.

Transforming existing office buildings to housing is also likely something that can only realistically happen in cities because of the existing zoning. Many city sectors are already zoned for multi-use properties. As such, it is less of a long, hard headache to apply to meet updated code requirements.

At the end of the day, this crisis points to the fact that cities are still adapting to a new way of life and developers are trying to stay on trend. However, this wouldn’t be the first time historically such a massive city conversion has occurred. The factories of the 1920s were gradually phased out and replaced by skyscrapers, thus becoming the birthplace of Corporate America.

So, there’s a precedent of success set for transforming cityscapes according to public demand, but still developers are slow to fund mass-conversions. The sheer cost of converting offices to housing has been enough to defer any real action. Not only are construction costs at play, but rising price tags for materials and labor, compounded by high interest rates are enough to stall adaptive re-use projections.

In the meantime, while property owners are still deciding what the fate of their commercial spaces is, their buildings are sitting empty.... Let’s talk about what this means for you.

Renegotiate and Relocate with a Tenant Rep

Corporate tenants have more freedom than ever to negotiate a great lease. Not a good lease, a great lease. The market is inundated with underutilized or vacant space. As landlords compete to fill their properties, they are offering more favorable terms, lower prices, and more generous concessions. This means if you are looking to extend or expand your tenancy, you will be put on a pedestal. Corporate tenants are now in the perfect position to create competition for their tenancy, leveraging its value to the fullest extent. You can achieve your best deal with skillful negotiation (or renegotiation if you’re several years into an existing lease).

There’s never been a more critical time to streamline your portfolio. And when you go into renegotiation, you want to trust your knowledge and level of preparation.

Even sophisticated tenants still may only enter the market once every five years. On the other hand, landlords are in the commercial real estate world nearly every day. To get the best terms and price, level the playing field with a True Tenant Rep™ at iOptimize Realty®. This is not the time to be using the landlord's broker, for more on that check out: What is a True Tenant Representation Broker? (And What to Avoid).

Working with a Tenant Rep is as if your company had a surrogate real estate department. You can offload your CRE responsibilities and stresses to trusted hands that only have your best interests in mind. As experts in negotiation, Tenant Reps are empowered to secure you the best possible solution for your commercial renegotiation.

The True Tenant Reps™ at iOptimize Realty® are also experts of relocation. We do business nationwide. So, if you want to join the movement to the suburbs, we can take care of the process while making sure you get the best and most efficient deal. However, if you want to stay in a metropolitan area, we’ll get you the best price, even in a tough market.

If you're ready to start saving today, talk to a True Tenant Rep™ at iOptimize Realty.®