Managing your company’s corporate real estate is a full-time job. With the market changing as quickly as it does, keeping up with trends while making steadfast decisions for your portfolio can feel like an overwhelming task.

Luckily, tenant reps can back you. As CRE professionals with over three decades of experience, we have seen it all. We have a history of helping New York organizations, specifically, save money and time. Our market expertise allows us to work with you to make the decisions that will benefit your portfolio in the short and long term.

If your CRE is in New York City, you know how expensive it is. Chances, are you are looking for areas to provide your budget relief.

The three methods that will deliver you savings are right-sizing, renegotiating, and relocating your existing leases. While the techniques can be used individually, they deliver the best results by working hand in hand. So, if any of the following questions sound familiar, this article is for you. We will explain what they are and how capitalizing on this system delivers savings.

-

Right-Sizing - Am I wasting money on extra space? How much space do I need?

-

Renegotiating - Am I paying over market- value for rent? What do I do if I am?

-

Relocating - Am I in the best location for my business? Where would I move?

Depending on your company’s needs, the system you should use will vary but read on if you are curious about how to significantly cut extraneous costs in your CRE portfolio.

New York CRE is Expensive

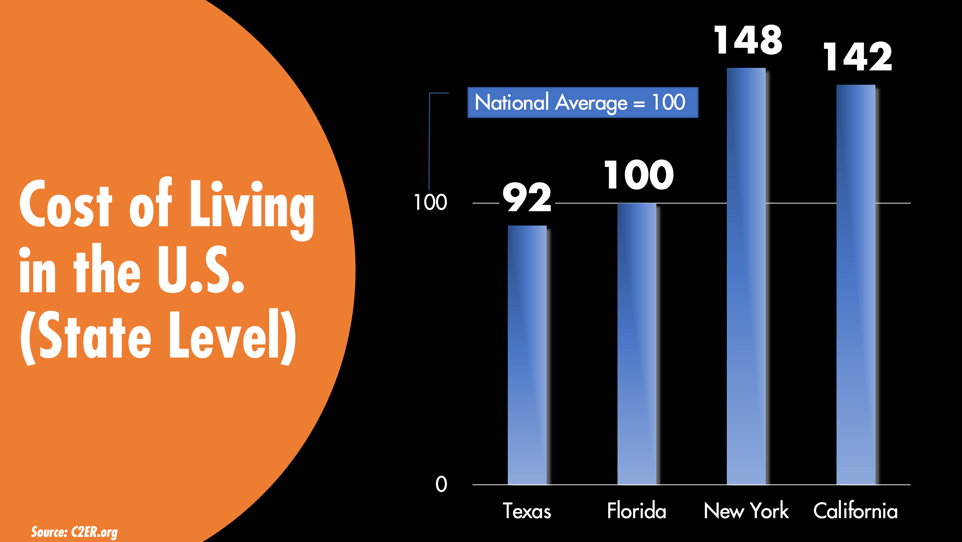

For this exercise, let’s say that you are currently located in New York City. It is no secret that the city that never sleeps is expensive.

Running a business in New York City is associated with:

- High corporate income tax

- Heavy income taxes

- Expensive payroll

- Costly office rent

- Overall higher cost of living

There is no reason to put up with the high costs. You have the option to cut your overhead expenses significantly.

The Market is More Flexible Than Ever

The pandemic and the subsequent work from home revolution have opened the eyes of corporate professionals to more possibilities when it comes to getting work done.

A lofty Manhattan office is no longer required to operate at a certain level of success. Online work has expanded our preconceived notions of the physical working spaces we occupy.

As a result, many organizations are letting their leases run out with no plans to renew. Or they are cutting down on unused space or moving to areas where prices are more affordable, like the suburbs or sun-belt.

The point is- you have more options than ever, and the market is in your favor. It is time to do something about it.

3 Ways to Save if You Lease NYC Commercial Space

If you are tired of New York City’s overhead expenses let’s run a scenario.

You have 50,000 square feet of NYC office space. There is about a year left on your lease, more than enough time to plan a move. However, your landlord is offering you a five-year extension to remain in your existing space to put more pressure on the matter.

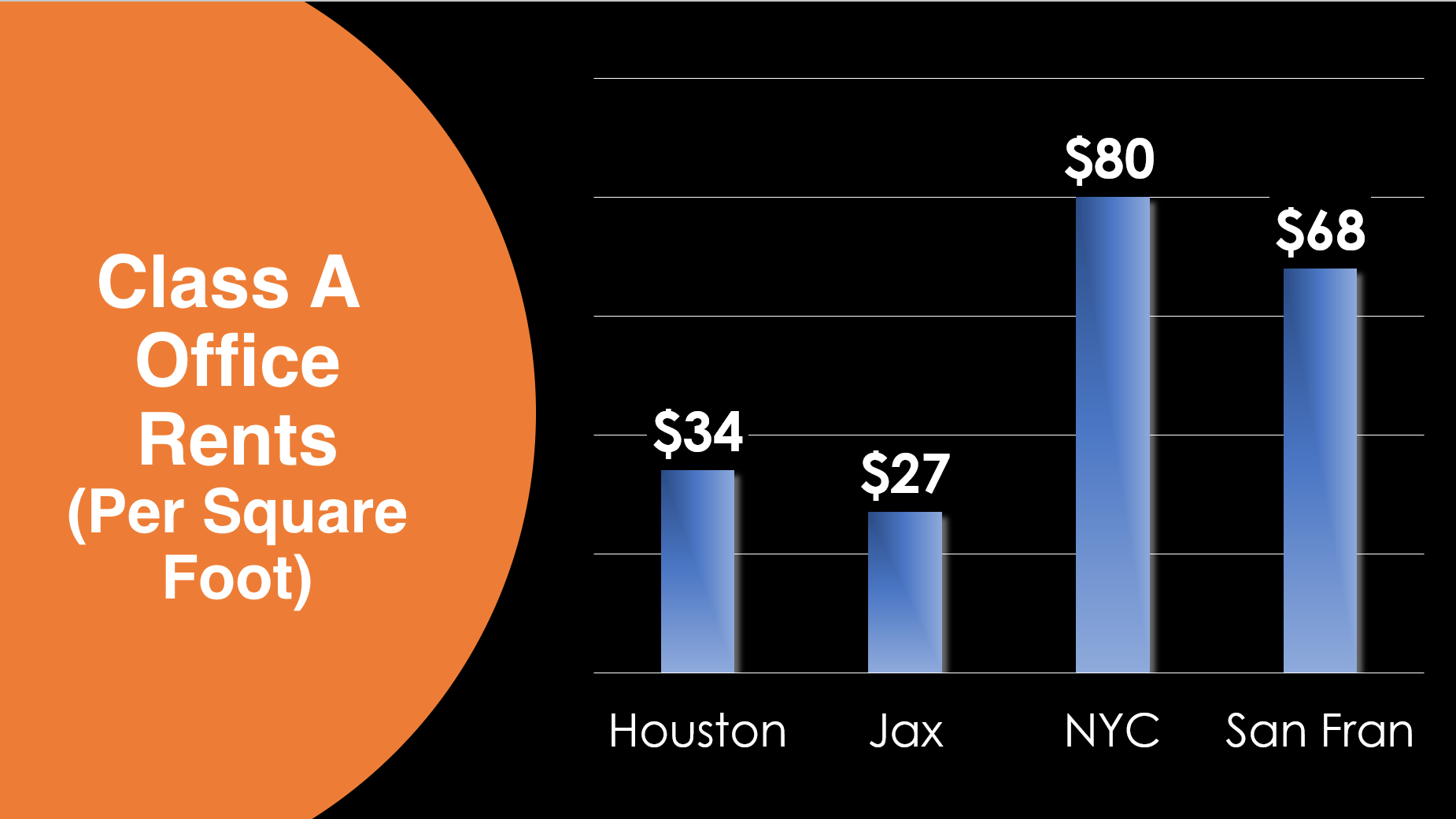

The demand for commercial space is currently low due to the work from home revolution. But you signed your lease several years ago when rental rates were a bit higher. The current average price for NYC office space is $70-75 per square foot. You’re currently paying $80 psf, and should you choose to stay you would also be subject to additional rental escalations.

Now, if you love your New York City property- you don’t have to move to experience savings. Let’s go through how.

1. Right-Sizing

Right-sizing will allow you to examine your current property and identify where you can cut away at extraneous space.

For organizations that are quickly growing, it will point out where you are overutilizing space. On the other hand, if you are looking to downsize, it will direct you to where you are underutilizing your current square footage.

Right-sizing can mean many things.

- A deep dive into your portfolio

- An assessment of how you use space

- An analysis where your utilization can become more efficient

How to Right-Size

The foundation of right-sizing is measuring your current space utilization and comparing it to your optimal utilization.

Let’s say that some of your employees are working from home still. Through reassessing how much space you need, you discover that you could cut down 40%. You only need 30,000 square feet.

Five years at the original utilization will cost you $20 Million. Right-sizing can potentially save you $8 Million!

Right-sizing alone will introduce incredible savings. However, landlords are usually unwilling just to let you stop paying for 40% of your space.

So, what can you do? Renegotiate the terms of your lease.

The value of skillful negotiation cannot be overstated. For example, you may be able to cut your space by signing for a longer-term in your property.

Let’s take a closer look at the next method that will save you CRE dollars.

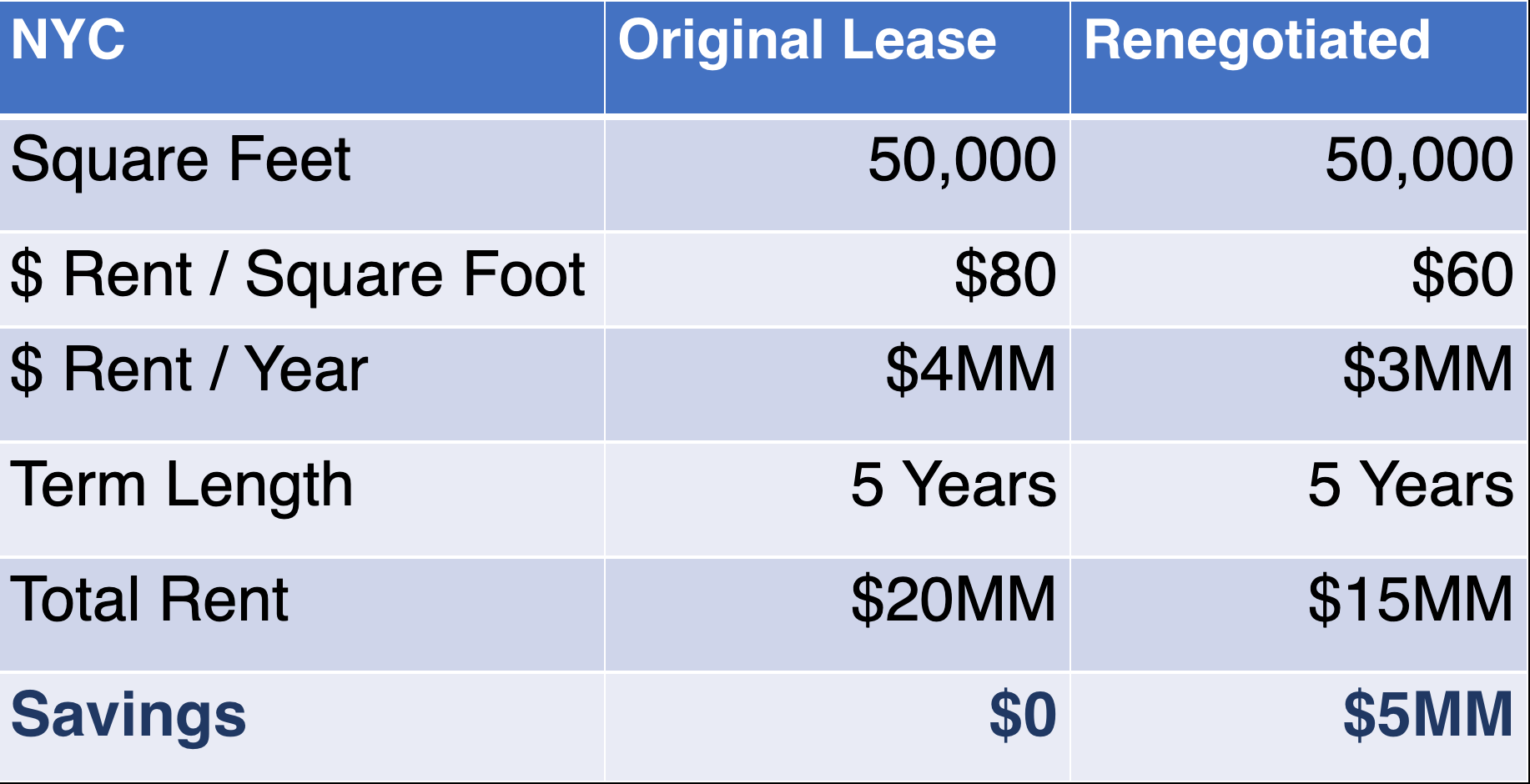

2. Renegotiating

Whether you are looking to cut down on your space or not, renegotiating can help you lower costs on your commercial portfolio.

For example, if you are several years into your lease, you may be able to reset your rent to current market value.

This is especially true now as the market is currently swinging in favor of tenants. Since many businesses have moved online, the demand for commercial space has dwindled.

How to Renegotiate

Fear of the responsibility and costs of vacant space has landlords more willing than ever to open up negotiation. This means that you can potentially get more perks included in your lease.

If you come prepared with a tenant representative, you stand to save even more. Tenant reps are experts in leveraging the value of your tenancy against landlords and their brokers. They often do this by creating competition amongst landlords. This critical step incentivizes them to drive down their rates and get you better lease terms, in the hope of landing you as a tenant.

Clients of tenant reps can save upwards of 30%. To continue our exercise, though, let’s be conservative here and say that renegotiating will let you save 25% if you keep your original 50,000 square feet.

So rather than $80/ square foot, you can pay $60/square foot.

By renegotiating alone, you can save almost $5 million. Remember that this step can also be partnered with right-sizing to further increase savings. These steps rely heavily on each other.

However, if the problem is not with your lease and lies in your location, renegotiating is not an option. So here we arrive at our final method, which can potentially deliver the most impressive savings.

Let’s see how.

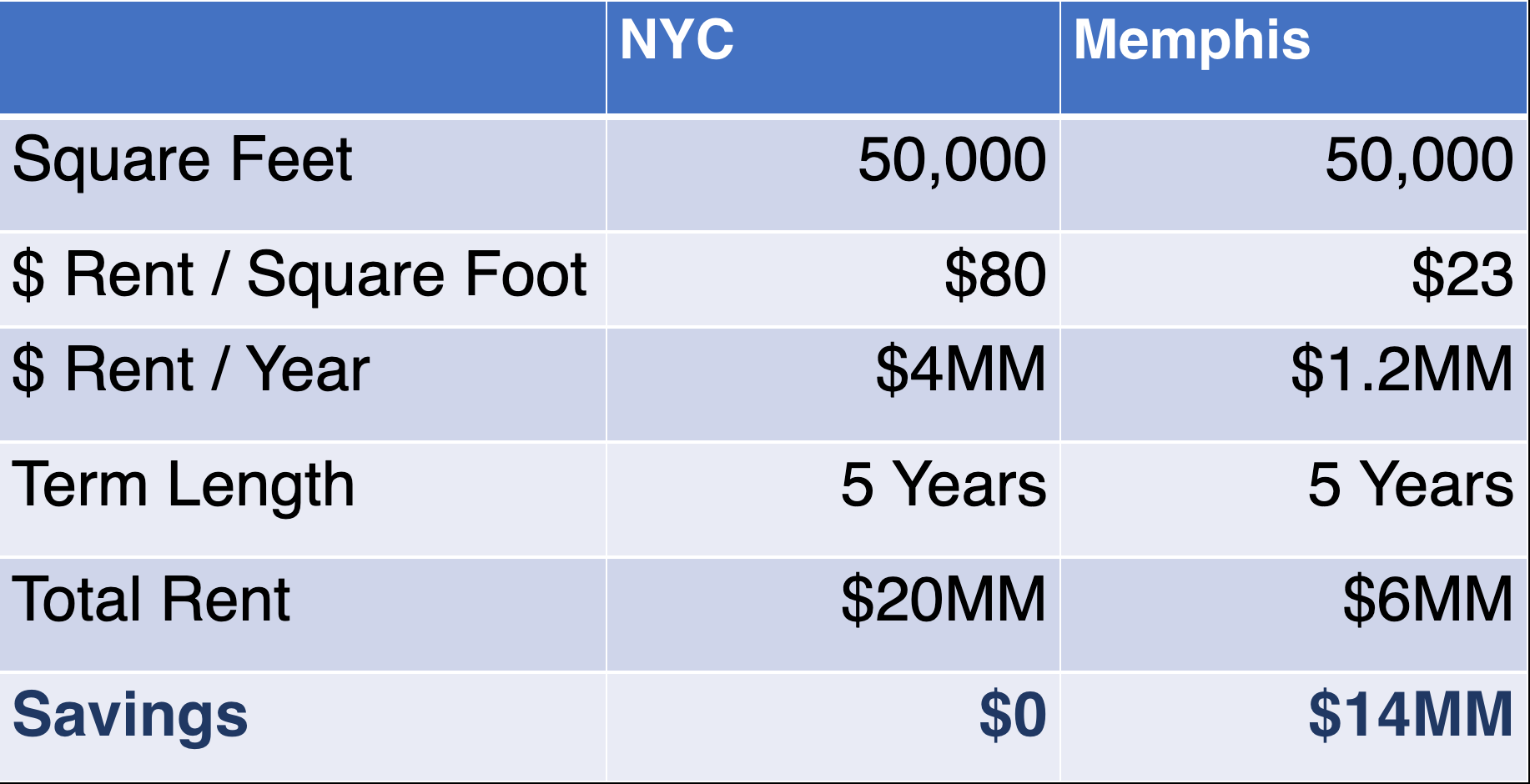

3. Relocating

The decision to relocate is not an easy one. However, if you’ve decided your current geography isn’t serving your business, you’ve already done the hard part.

The question of the hour then is- where should you move?

There are a lot of attractive regions for businesses sprouting up in the last few years, specifically along the sun-belt.

States like Florida, Texas, and Tennessee, just to name a few, offer competitive environments at highly reasonable rates.

For this scenario, though, after extensive deliberation with your team and real estate rep, you decide that Memphis, Tennessee, may be the best place to shift your operations.

Its cost of living is significantly below the national average, and it is a hub for the transportation and manufacturing industries.

The average office rent price is too tempting to deny at $23/ square foot.

This savings metric considers a flat rental rate. It doesn’t account for the full savings you could experience moving to Memphis where costs like taxes and operational expenses are significantly cheaper.

How The 3 R’s Can Help You Save on Your Commercial Lease

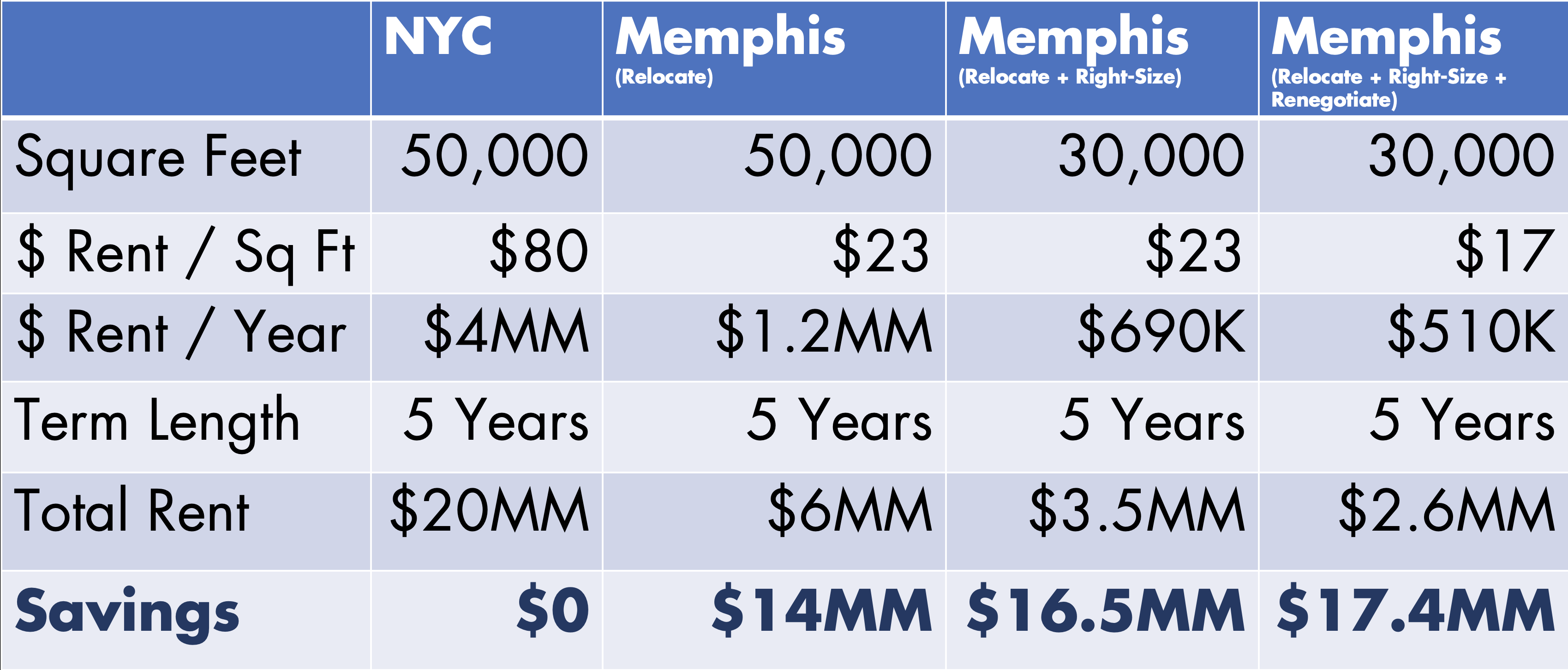

We went through how the 3 R's can each save you individually. Now let's look at what your costs would total if you combine these steps.

Using the 3 R’s, you have the potential to save 83% on your CRE overhead.

If you move to a more business-friendly area, you can also save on payroll, taxes, gas, and overall cost of living.

In addition, since these places are cheaper to work and live in, the power of the dollar is stronger. As a result, consumers have more of an ability to freely spend, potentially furthering your financial benefit from moving.

All said and done, the 3 R’s is a process that promises efficiency and savings. Each step could be used individually or in conjunction with the other actions.

How A Tenant Rep Can Help With the 3 R's

If your organization is wasting money on expensive or unused space now is the time to act. Right-sizing, renegotiating, and relocating have helped many organizations lower their overhead, and yours can be one of them.

Each step can be used individually. However, the maximum savings will be achieved through using the techniques simultaneously.

If the process seems overwhelming, don’t worry. Tenant reps created the process of the three r’s and have carried out the steps successfully countless times.

At IOptimize we have helped New York businesses benefit their CRE portfolios through this process many times. We provide assistance at every step, from deciding that you have room to improve your CRE to closing the deal with your new landlord.

Ready to talk to a tenant rep? Schedule a free consultation today!