No state is perfect. Each has its own pros and cons. When deciding where to relocate your business, you just have to prioritize what qualities you want in a location.

Some states are more conducive to corporate success than others, and Texas has consistently ranked among the most business-friendly areas.

Its laws and culture provide a steady pro-business environment that has helped thousands of organizations slash overhead costs.

So, if you are tired of your region’s elevated expenses, Texas may have what you need.

As tenant reps, we have 30 years of experience helping companies make the wisest decisions for their CRE portfolios. We have found that there is a major industrial push towards the sun-belt and away from business- unfriendly areas. Texas continues to be one of the most popular locations for a corporate relocation- and with good reason.

We aren’t saying that a move to Texas is right for everyone. This is not a one size fits all relocation. We are just laying out the reasons why companies are already finding success after moving to Texas.

If you’re interested in learning more, read on. We outline why Texas provides companies relief in terms of:

1. Taxes

One of the most compelling reasons businesses are relocating to Texas is its tax conditions. Let’s go through some rates that make the state so appealing to corporations.

- 0% Corporate Income Tax

- 0% Personal Income Tax (Top Bracket of Earners)

- 8.25% Combined Sales Tax Rate

No Corporate Income Tax

Corporate income tax can be a significant expense for businesses. This is especially true if you are located in Chicago or Pennsylvania, where corporate income is taxed at 9.5% and 9.99%, respectively.

We are talking big money lost to excessive tax laws with large-scale organizations.

Thanks to its generous regulations, many Fortune 500 companies have found success in the Lone Star State. It is a hotspot for fiscal revenue in every industry, from gas to technology.

The 0% corporate income tax is one of the main reasons the International Economic Development Council consistently scores Texas as one of the top 5 states for business.

No Personal Income Tax

Organization heads find even more reason for relocating to Texas when considering the 0% income tax percentage for the top bracket of earners.

Entrepreneurs like Elon Musk have a lot to gain from moving from business-unfriendly areas to Texas. He recently transferred Tesla from California to Texas and reported that the primary impetus was personal.

Earners in his tax bracket can save a lot by making a similar move. The rate in California is almost 14%. High-earning New Yorkers can gain even more by shifting to Texas. The New York taxation rate for this category is nearly 15%.

Going from 14/15% to 0% on income tax will introduce substantial savings.

Lower Combined Sales Tax Rates

Consumers in areas of lower standard charges, like sales tax, have more freedom to spend. As a result, the power of the dollar is stronger and local economies benefit from more stimulation.

Sales tax rates can quickly add up for businesses with significant purchasing power.

While Texas does not have the lowest sales tax in the country, its business-friendly rates are reasonable again compared to other industrial centers.

Chicago and Pennsylvania’s sales tax percentages are through the roof at 10.25 and 11.87, respectively.

This metric is another reason Texas tax regulations are so attractive to businesses looking to reduce expenses wherever possible.

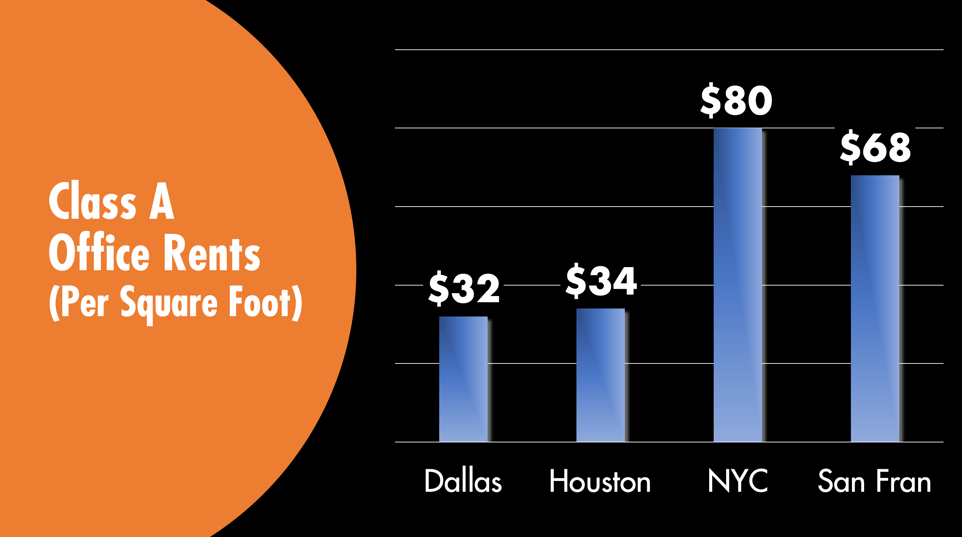

2. Affordable Office Rent

In comparison to other popular destinations, Texas has reasonable rent rates for office space. When corporate real estate is typically an organization’s second most significant cost, moving to areas of low rent can seriously cut your overhead spending.

Let’s look at three of Texas’ most popular cities and what they charge for one square foot of office space. As a control, we will use San Francisco and New York to understand what other prominent cities across the country are charging.

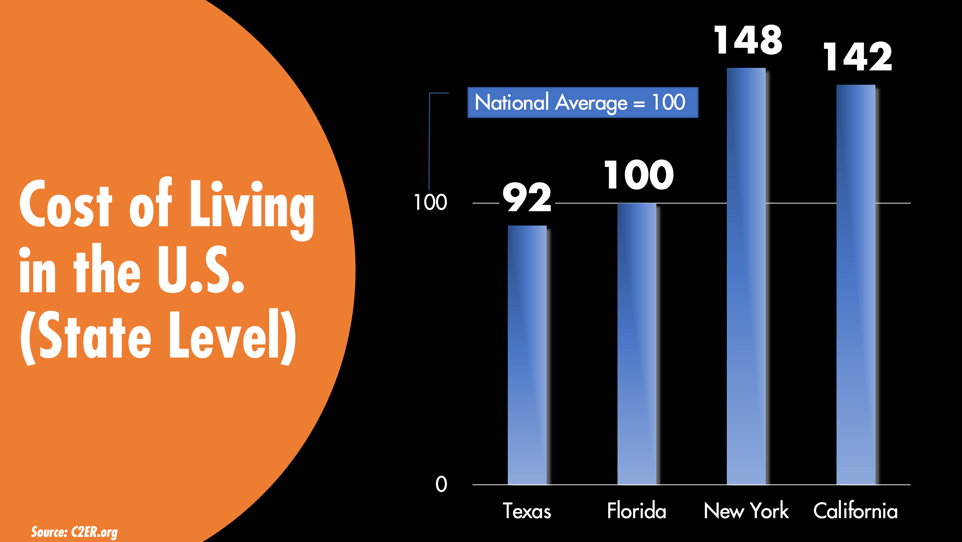

3. Reasonable Cost of Living

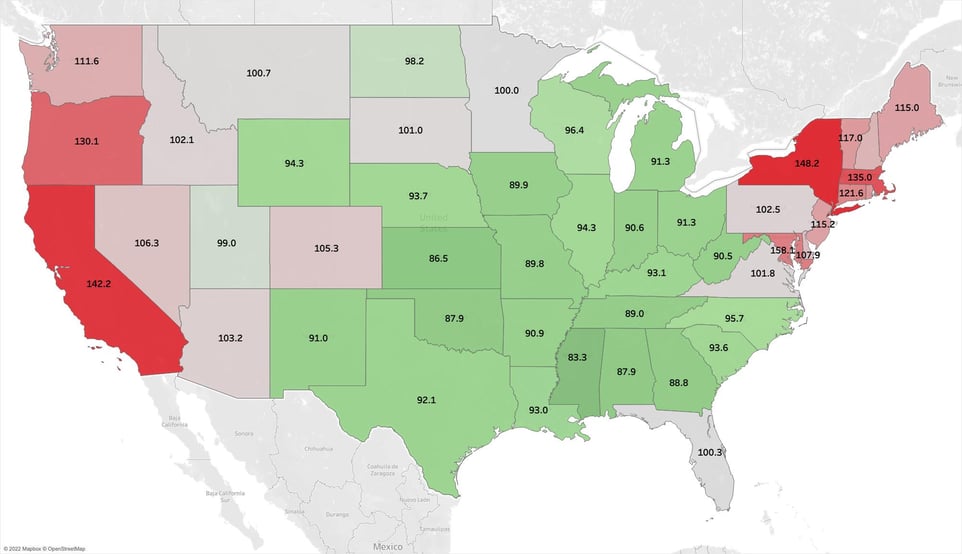

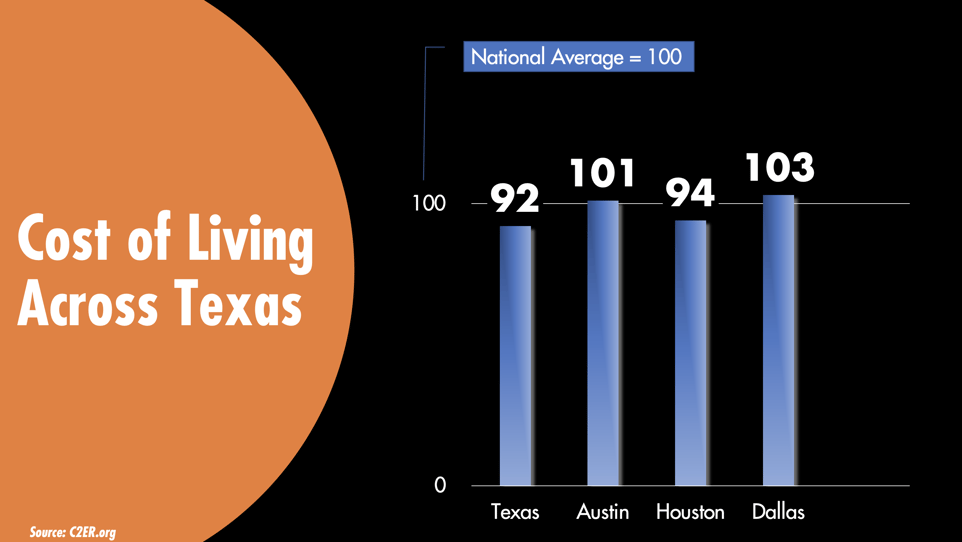

An area’s cost of living identifies how affordable it is to live and work in. The number is determined by comparing the average price of goods and services in areas throughout the country.

The national average is 100.

(Cost of Living where National Average is 100)

Like with regions of lower sales tax, when everyday costs are lower, economies benefit from increased spending.

Texas's average cost of living is below the national average at 92, making it highly affordable and conducive to financial success.

This number will vary depending on where you are in Texas. Of course, cities are generally more expensive to work in, but the cost of living in Texan cities remains reasonable.

Texan cities remain around the national average for living expenses. Even though Austin lies on the higher end, its metric is nothing compared to places like Manhattan, New York and San Francisco, CA.

Manhattan is at 255, while San Francisco is at 194. These numbers are not feasible for long-term financial success.

Overall, Texas is highly affordable for businesses and people alike.

4. Talent Pools

Texas is an emerging hotspot for young professionals. As a result, the talent pool is stronger than ever, offering excellent options for companies that are looking to expand their personnel. If you have exhausted your local talent pool and are looking to relocate, Texas is an optimal location to do so.

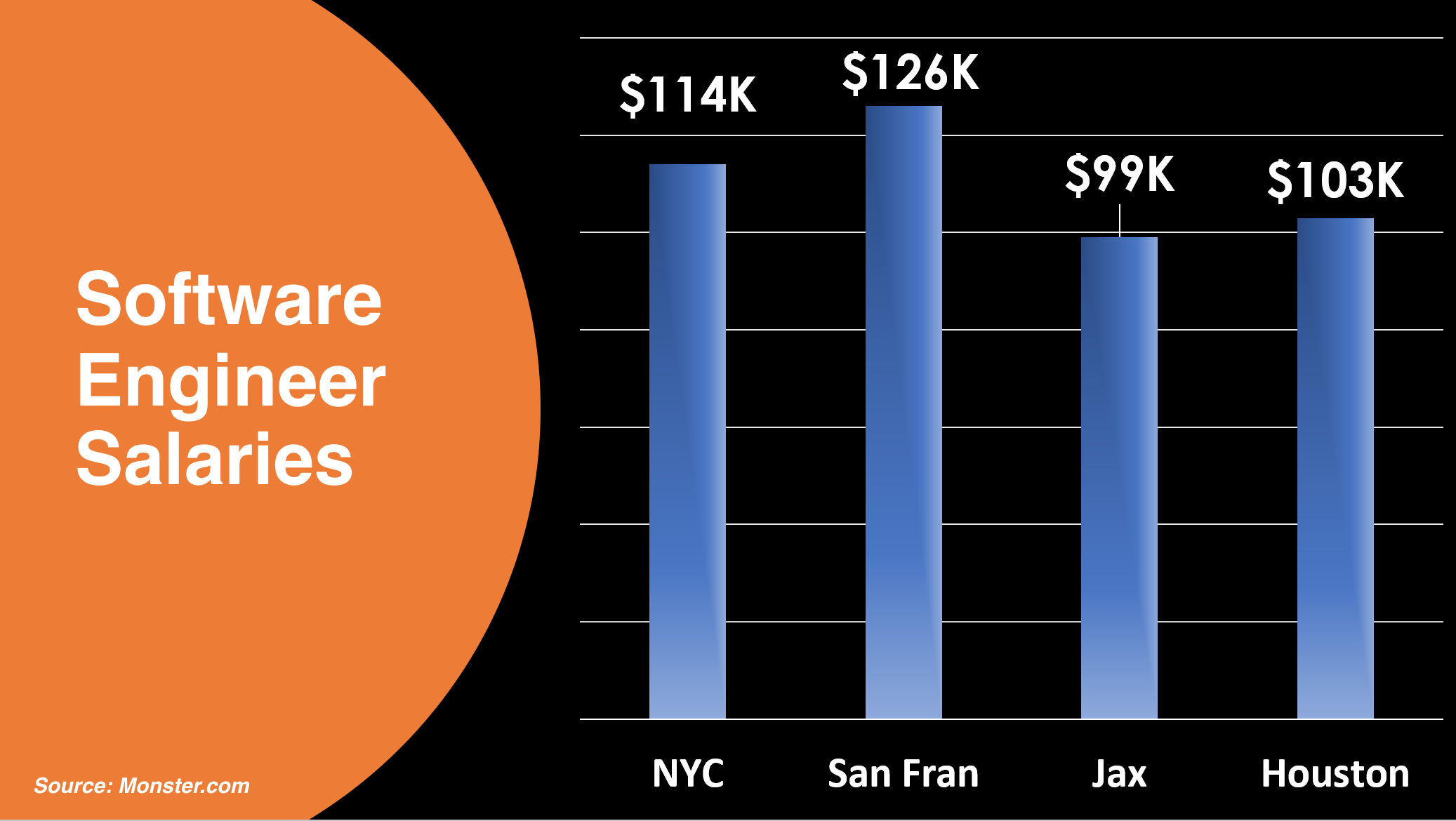

With many high-ranking institutions, Texas also possesses a highly educated workforce. Yet, payroll prices still remain reasonable.

Lower payroll costs mean big savings for companies as employees are typically the most considerable expense for organizations.

Let’s look at the difference in average salary for a common position like a software engineer in popular business across the country.

As you can see, Texas professionals are available at highly practical rates.

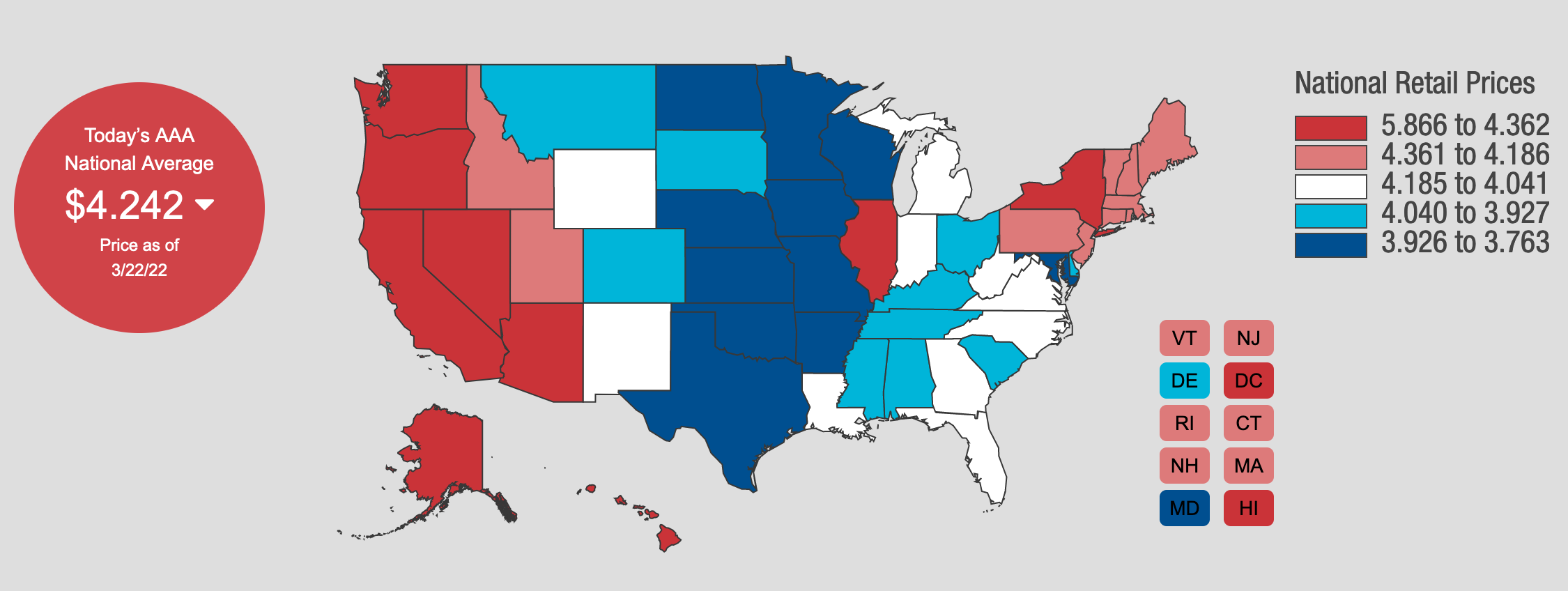

5. Gas Prices

Texas has among the lowest gas prices in the country. This has broader implications on its economy. When prices are higher, it decreases consumer spending in other realms. Low gas prices go a long way to keeping the money you earned in your pocket.

Companies are free to perform without excessive overhead costs. Gas prices for businesses can quickly add up, especially for transportation-based industries.

(Data According to AAA as of 3/22/22)

The difference in gas prices is starkest from California to Texas. With this metric, you can save almost $3.00 per gallon!

How a Tenant Rep Can Help You Move To Texas

Overall, moving to Texas will introduce incredible savings to your CRE portfolio. Not only will your real estate costs decrease, but your general overhead will be reduced, improving your bottom line.

If you think you are ready to move to Texas, tenant reps can help you. They will work with you throughout every stage, from identifying optimal properties to negotiating to land you the best terms.

If you are not ready for a cross-country move, tenant reps can still help. Their market intelligence assists organizations in making informed real estate decisions. This may mean not moving at all, moving to the suburbs, or moving down the block.

By solely protecting your interests, tenant reps will support your CRE portfolio in ways other real estate professionals can’t.

Want to learn more about working with a tenant rep? Check out this article!