Managing occupancy costs is important for your company's bottom line, making it important that you don't overlook anything that is contributing to your figures. Being aware of the following hidden and erroneous costs can help you avoid unpleasant financial surprises:

1. Errors in Common Area Maintenance (CAM) Fees

Periodically, you should do a thorough audit of the CAM expenditures that your company has paid for, as errors may be causing you to pay more than you should. Be on the lookout for items that were accidentally duplicated and for eliminated expenses that are still being assessed.

Also, make sure that any refunds that should have been credited to your account, like those from a real estate tax refund, were properly applied. It's also important to crunch the numbers for yourself. Mathematical mistakes happen frequently, and they can be costly.

2. Square Footage and Unused Space

Have your office measured by an architect to verify that your base rent is being calculated by an accurate square footage figure. You should also double-check the square footage of common areas. Sometimes, unusable areas of a building, such as elevator shafts, end up in the calculations.

Also, assess how much unused space you have in your office. Every square foot that isn't being utilized is a waste. Taking steps to consolidate offices or sublet part of your office can help to offset the cost of occupying space you aren't using.

3. Abatements That Aren't Truly Free

If your landlord agreed to a rent abatement, make sure you read the fine print. In some cases, abatements simply defer rent due until the end of the lease. With this type of arrangement, you'll find yourself on the hook for a large lump sum that you may not be anticipating.

4. Rent Escalations

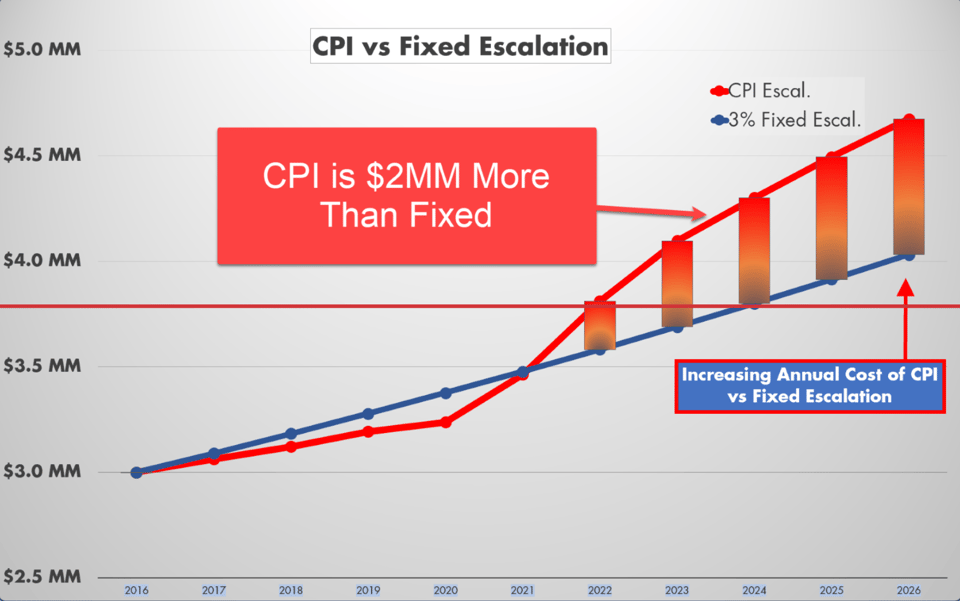

When considering occupancy costs, you need to think about the future and not just the present. Examine the escalation clause in your lease to determine if and when your base rent will increase. Depending on the type of agreement you have, your rental rate might be tied to a third-party index, such as the consumer price index, meaning that the amount you pay could increase suddenly.

5. Added Utility Costs

Windows that aren't properly insulated, leaky faucets, old office equipment and thermostats that aren't adjusted when employees are out of the office can all mean wasted money in the form of increased utility costs. Finding sources of water and electricity waste and taking steps to address them will lower costs and help protect the planet.

6. Additional Fees

Examine your lease to determine whether administrative and management fees are assessed on top of your base rent and CAM. These additional fees can add up to big expenditures over time.

7. Services Not Included in Your Lease

Get a clear picture of what is and isn't included in your lease. Do you need to pay extra for security? Janitorial services? Groundskeeping and snow removal? Plant care services? Water delivery? All of these services need to be figured into your occupancy costs for accurate accounting.

Here are a few other articles we think you'll enjoy:

7 Advantages to Having Suburban Office Space

5 Reasons Why Companies Are Fleeing CA and NY for FL and TX

Subscribe to our blog for more CRE tips!!