A few years into the pandemic, in-person work has finally returned to the cultural zeitgeist. Yet, even with more companies returning to their corporate spaces (at least on a hybrid schedule), there is still a spatial utilization crisis.

Many offices are still sitting empty, with record vacancy levels taking hold of major markets and central business districts.

This underutilized CRE (Corporate Real Estate) is even more so a liability as Recession threats loom over the nation. All this culminates in the fact that companies have too much space and are now going to great lengths to cut their losses. And, for many, subleasing is not the solution they thought it would be.

Trouble in the Metaverse

If you weren’t already suspicious of a fiscal crisis, how’s this for a canary in the coal mine? Meta, the cutting-edge tech behemoth, is making news by slashing its numbers and corporate footprint.

This comes several months after they signed one of the largest office lease deals in history. Meta was poised to inhabit the 589K square foot, 66-story tower in Austin, Texas, and by doing so tell the working world with a statement that: We are here, we are at the top of our game, and we believe in the value of in-person collaboration (and can afford to invest in it).

Meta intended to occupy Austin's largest tower. Image source: The Business Journals

Meta intended to occupy Austin's largest tower. Image source: The Business Journals

Well, what could go wrong with slapping an additional 600K square feet to your footprint amid a spatial utilization crisis? Maybe exactly what you would think...

Meta was forced to put a freeze on hiring and CRE expansion. And, instead of moving in and occupying the space themselves, Meta now plans to sublease the building. This is an indication that like everyone else, they are not immune to the financial fears of an oncoming recession. Many companies, even innovative big tech giants, are taking a step back to refine spending and become more efficient to weather an economic storm. This is especially since according to GlobeST,

|

“U.S. leasing activity by the tech industry... remains 35% below pre-pandemic levels...Sublease space across the Tech-30 is elevated at 3.8% of available space.” |

At the same time, many have seen the answer to reducing CRE spending lies in the current problem: that offices are dramatically underutilized since COVID. Corporate real estate is typically an organization's second most significant cost. So, when you cut the fat here it goes a long way.

Traditionally, the first step to get closer to your optimal space utilization is Right-sizing. To learn more about this, check out this article. However, for many companies, the question is not whether they have extra space, but what to do with it.

So, what do you do with it?

The Current Problem with Subleases

Well, the most obvious answer is to sublease extra space. And therein lies the current crisis: there’s too much sublease space on the market.

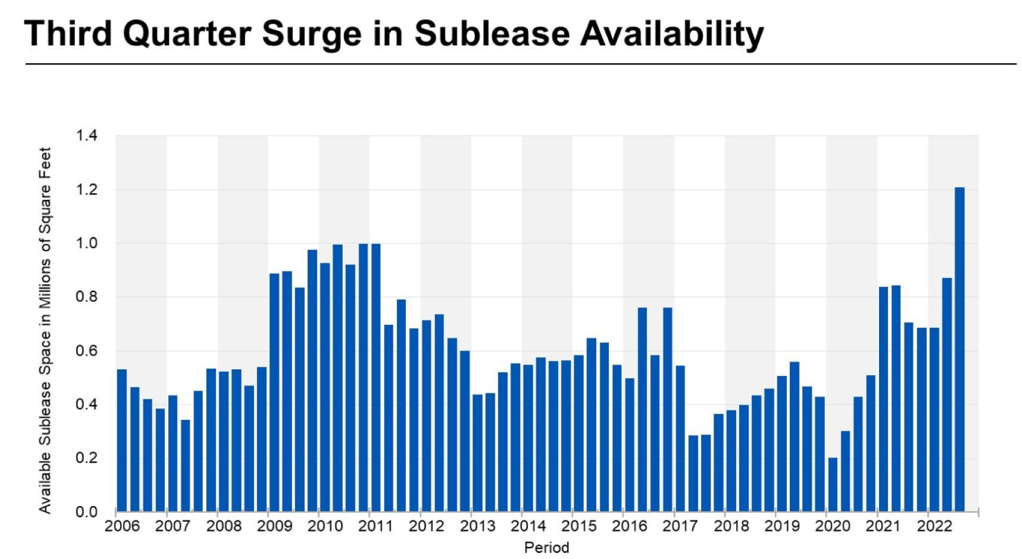

Sublease availability is surging, according to CoStar.

Sublease availability is surging, according to CoStar.

Sublease space has become a flimsy band-aid on a gaping wound. While it was never a perfect solution, subleasing space helps companies like Meta avoid expensive lease termination fees. It also positions them to take occupancy if and when they are ready for move-in.

Subleasing also helps businesses make back a portion of rent dollars that they would have otherwise lost entirely. But that’s another key caveat. To keep the CRE chain from toppling on its head, even when the market's rising, landlords won't allow their tenants to profit by subleasing. But, in almost every market, sublease space is discounted...But in a recession, it's going to be a fire sale.

So, subleasing space still represents a significant loss for the original tenant. Look at Meta. Even with subleasing multiple leases, they are still deep in the hole. According to the RealDeal,

|

“Meta executives said on an earnings call that the firm expects to spend more than $3 billion to decrease its office footprint. The company already shelled out $413 million last quarter to end office leases and expects to spend another $900 million this quarter.” |

Subleasing is a costly solution- and on top of that, it comes with more responsibility. You can’t cut your losses entirely with an old space, as you now take on a landlord role with the new sub-tenant. You are responsible for finding a tenant, negotiating the lease, and making any necessary repairs or renovations. If you're already managing an extensive portfolio, you're adding more to your plate. But you may not even be able to cross that bridge until you come to it.

The other point is that with the sublease market so inundated right now, it’s nearly impossible to find a subtenant. There has been an increase in sublease space since 2020. As a result, it’s increasingly more difficult to find a tenant. For example, in the Twin Cities, sublease availability has increased by 4X, according to the Business Journals.

This is the same issue experienced by landlords: few companies want to occupy space right now. As a result- the already cheap subleased space is now being listed for cents on the dollar to find a willing party.

Sublease Space by Region

The sublease market is experiencing a lot of action throughout the entire country, with certain pockets of heightened activity. Northern metropolitan regions are currently experiencing the most subleases. However, even along the sunbelt, where financial and population growth has been more sustained, CRE markets are flooded with extra space. According to a Trepp analysis, ”The high cost of living in metro areas that lost residents since the pandemic started generally have the highest amount of sublease space (Los Angeles and Minneapolis). The higher growth counterparts to these areas tend to have lower amounts of sublease space (Dallas-Fort Worth and Nashville).”

So just like with all other features of business, you may have more trouble in cities like NYC if you want to sublease. However, record high-sublease rates are consistent across the country still.

Abundant Subleases are Making Landlords More Competitive

With so much sublease space on the market, it’s influencing all other branches of corporate real estate. Landlords can’t keep up. While already struggling to find new or renewing long-term tenants, property owners now need to compete with subleases. To do so, it’s further driving down the market rate of Class A office space. According to Propmodo,

“Competing with sublease space means offering concessions because lowering rents can have a negative impact on building valuation and, worse case, even trigger loan covenants. Historically high concessions have pushed net effective rents to 14.7 percent below pre-pandemic levels.”

This means that corporate tenants have more power to negotiate for lower rents, better concessions, and more favorable terms. If you are looking for new space, you can capitalize on this market. Use the record-high sublease availability as a negotiating chip. If one landlord doesn’t want to offer you a premium for your tenancy, another will. If you are several years into a lease, you have the potential to renegotiate the existing terms and clauses. Your landlord may be willing to offer you more concessions if you sign on for a longer period. Your tenancy represents guaranteed income... so they may be willing to sweeten your deal if you extend your stay. This is especially true because a long-term tenant is a lot more attractive than a transitory sublease.

So why are you paying expensive escalated rent as the property value of the neighboring buildings plummets?

How Tenant Reps Help You Take Advantage of Subleases

There’s never been a more critical time to negotiate and streamline your portfolio. And when you go into renegotiation, you want to trust your knowledge and level of preparation. Even sophisticated tenants still may only enter the market once every five years. On the other hand, landlords are in the commercial real estate world every day. To get the best terms and price, level the playing field with a true Tenant Rep.

Working with a Tenant Rep is as if your company had a surrogate real estate department. You can offload your CRE responsibilities and stresses to trusted hands that only have your best interests in mind. As experts in negotiation, Tenant Reps are empowered to secure you the best possible solution for your commercial renegotiation.

At iOptimize Realty,® we are true Tenant Reps with 30+ years of experience market intelligence, analyzing trends to direct our corporate clients to big savings. We have seen how sublease space has evolved and left room for the right tenant to dramatically reduce their overhead. Don’t become complacent in a space that is actively losing money. Work with a Tenant Rep at iOptimize Realty,® to renegotiate your commercial lease and dramatically improve your workspaces and bottom line.

Learn more about how to ensure your sublease clause works for you: Why a Properly Negotiated Sublease Clause is Critical to Your Commercial Lease.