A recession is nothing new, but what we’re seeing is much worse. Record government spending and increased reliance on remote means have changed the face of business. Simultaneously, severe inflation is hijacking the prices of goods and services, sending them through the roof.

What can you do to not only stay afloat but keep your business succeeding?

Adapt.

As tenant reps, we have helped our corporate clients slash their overhead and reduce spending by reassessing their real estate. So, read on to learn more about this crisis, how it has changed our working culture, and what you can do to get ahead.

1. Why This Recession is Different Than Others

2. The Emergence of Knock-On Inflation

4. Other Options You Have to Improve Your CRE Budget

Why This Recession is Different Than Others

There’s been recessions before, but modern times call for modern crises. Unfortunately, the economic and cultural circumstances of the last few years have mingled to create the perfect storm for fiscal anxiety.

First, the economy was pumped up by record government spending. Huge amounts of stimulus dollars for a prolonged period of time have created record inflation. The FED must now slam on the breaks or risk inflation spiraling out of control.

Not only was our national financial system propped up, but it occurred in a time of great uncertainty. The pandemic forced many businesses to struggle as reopenings were teased but followed only by more lockdowns. And even a war in Europe. Who would think?

In the meantime, commercial real estate properties mainly remained vacant with “TBD” reopening dates.

To cope, corporations increased their reliance on remote capabilities (and it worked). Our technological infrastructure is more vital than ever, and the successful online transition changed how we think about business productivity.

Generally, as a result, there has been a reduced demand for office space. While commercial leases typically outlast economic disruptions, this prolonged crisis and cultural shift have changed CRE permanently.

|

Leases signed years ago that were necessary then are now costing companies millions to have a name on the door. |

The past two years have been interesting, to say the least, with the WFH movement. Companies that have budgeted and were planning to reopen their offices may be rethinking that.

So real estate demand is down. What else? The economy has also come down with a nasty case of knock-on inflation.

Knock-on Inflation and Your Budget

Everyone is worried about inflation as it causes the price of everything to go up by the day.

Where have we been hurting the most as a country? Our energy field... For most people, that means heat, and electricity, but by far, it is felt at the gas pump.

Energy is skyrocketing, thus causing “knock-on effects” on everything.

When the price of consumer goods goes up, like what sells at Walmart, Target, Amazon, etc., that’s one thing. In normal circumstances, typically reducing demand would be used to combat inflation.

But, when the price of energy goes up, it causes a secondary effect or a “knock-on effect,” which causes the price of everything to go up. So, the energy price inflation compounded with consumer good inflation puts the country’s financial state in turmoil.

A company can do its own battle against inflation to help weather the storm. In many cases, cutting some of the top costs is the quickest way to achieve this goal.

|

The top two corporate costs are payroll and real estate. |

Slashing the workforce is common but leaves the company with plenty of unused space. When companies have already reduced space from the WFH movement, talent cuts will save money in payroll but drive-up real estate costs even more.

What You Can Do Instead With Your CRE

You now have a unique opportunity to cut costs by reassessing your commercial space. The office sector is not dead- it’s adapting.

For the foreseeable future, there will always be some demand for corporate working environments. This is especially true as game-changers like Tesla require employees to return to physical working spaces.

However, we have adjusted to living with post-pandemic circumstances. For example, while office space demand dwindled, industrial space demand remained strong due to the increased popularity of online shopping. But, business ebbs and flows. Moreover, manufacturers may now be feeling more pain due to rising gas prices– and, as such, can still benefit from reassessing space utilization.

Assessing space utilization can mean many things. For offices, new concerns should be considered:

- Do I still need the same amount of space as I did pre-pandemic?

- Should I be basing my optimal utilization on seats or employees (remote & in-person)

- How can I discard wasted space in my CRE portfolio?

- How can my CRE portfolio become more efficient?

For industrial spaces, these concerns (among others) should be analyzed:

- Am I still in the most cost-effective location?

- Will changing my geography reduce energy costs?

The trend for offices is downsizing as they adopt hybrid or WFH workplaces. So, what do you do with this wasted space costing you millions?

If you are near the end of your term, you can either relocate to a space that better suits your spatial demands or renegotiate for smaller square footage. Downsizing to the necessary number of seats rather than the number of employees (who may be working at home) is an excellent method to cut down on extraneous space.

If you are not near the end of the term, you can find a sublease. While you may not be able to make back all your CRE dollars, you will dig yourself out of the hole in your budget.

For a large-scale organization, money saved in reducing overall space and subleasing will quickly add up.

Other Methods to Benefit Your CRE Budget

Since demand is low and inflation is high, you may be in a position to renegotiate your lease. This is especially true if you are coming up on the end of your term or looking to expand. You likely signed your lease before the drop in real estate demand, so reducing your rent to market value is a genuine method to save millions while reducing your overhead.

On the other hand, if you are concerned about inflation and gas prices, you have other options. High gas prices are not only a concern for manufacturers. Operating expenses have gone through the roof due to expensive gas. You are the main party responsible for these costs if you don’t have a firm cap negotiated into your lease.

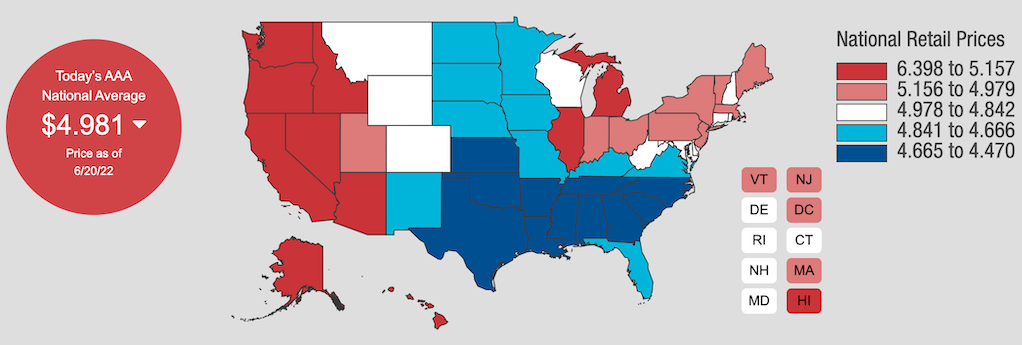

Certain business-friendly states have stabilized their gas prices to what they can. For example, look at the difference in cost of New York or California gas versus what Texans pay. If you are near the end of your term, relocating to a more fiscally affordable state will also significantly reduce your overhead in the cost of living and gas.

Gas prices according to AAA (as of 6/20/22) are at a record high.

The other long-term option you have is implementing sustainable energy sources. Expensive gas coupled with more ambitious progressive policies to reduce national reliance on fossil fuels- businesses adopt green CRE. Going green can reduce your operating expenses while allowing you to move away from volatile gas swings. Similarly, since government programs usually offer incentives and breaks for adopting sustainable practices, your budget will get an additional boost.

Recession? Work with a Tenant Rep

As we enter a recession, your budget has many moving parts to keep track of. Changing workplace culture, skyrocketing gas prices, wasted space, and knock-on inflation threaten to wreak havoc on the finances of unprepared corporations.

|

Get ahead of the recession and make adjustments to your real estate now. |

What many companies don’t realize is how much money they are wasting in pockets of inefficiency within their real estate portfolio. Tenant reps are experts at identifying where there is room for improvement. As a result, they are an invaluable asset for the wise tenant in the current financial crisis.

Tenant reps can help identify your optimal utilization and how to achieve it, and implement other methods of streamlining your CRE costs.

Learn three things every tenant should be doing to prepare their real estate for the recession.