Successfully navigating the ever-changing landscape of the office market demands that tenants stay informed and adaptable.

In certain regions, high vacancy rates have become the prevailing trend, highlighting both the challenges and opportunities presented to businesses. Understanding the dynamics of office markets with the highest vacancies is crucial for tenants seeking to make informed decisions about their long-term leasing strategies.

So, in this article, we will explore some of the key markets experiencing high office vacancies and delve into the reasons behind these trends. By staying aware and proactive, tenants can position themselves to capitalize on favorable conditions and optimize their leasing outcomes.

1. San Francisco

What can be said about San Francisco’s dismal leasing environment that hasn’t already been said?

From a complete turnaround in the tech sphere initiating a drastic pullback in the demand for office space to complicated regulations, high taxes and living costs, San Francisco has been left with dangerously high vacancy rates.

Part of the problem is the unlucky fact that the industry that took root in San Francisco, big-tech, easily lended itself to a seamless transition to online work arrangements.

|

"Some markets, like San Francisco… may potentially see more impact from remote working than others, because [of] the higher cost of office rent, cost of living and cost of commuting, while they are also markets that supported significant remote working even before the pandemic.” -Yahoo Finance |

But there was trouble on the horizon even before the pandemic. The high leasing demand and flourishing environment triggered expensive rent and living costs. Some businesses including Charles Schwab already had plans to move their offices to lower-cost environments, particularly in Texas.

And from its pre-pandemic vacancy rate norm of 7% in 2019, rates have exploded, even reaching 28% in downtown areas. Now couple this with a dismal occupancy rate of 44%.

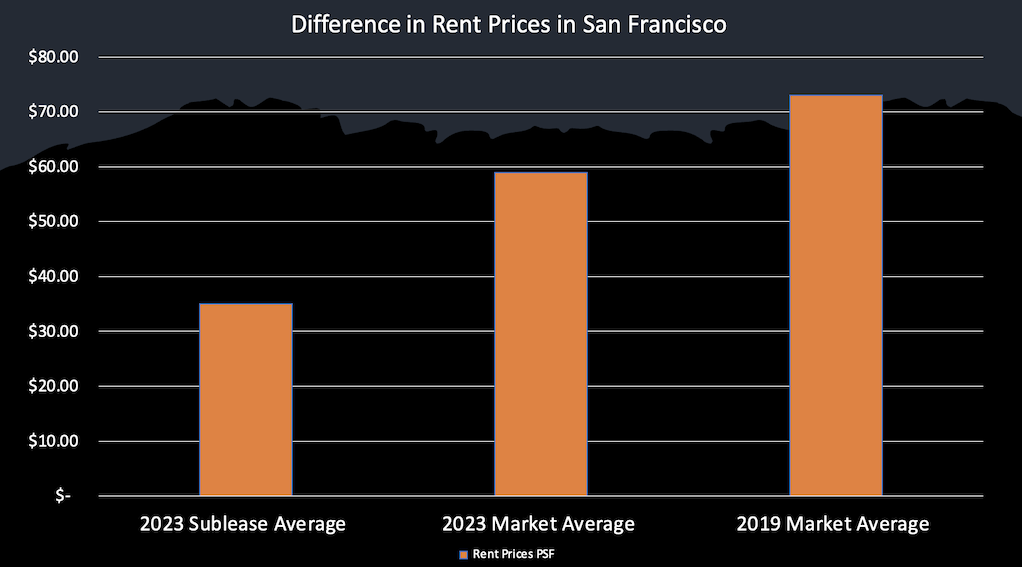

As those drastically under-occupied leases come due, they will exaggerate an already market clogged by empty office space. The over-saturation will become far worse indicated already by dropping rents and hundreds of thousands of square feet hitting the sublease market.

Rents have fallen drastically, and sublease space which is burdening the market as more businesses gradually cut ties, is advertised at $35 per square foot on average.

But beyond the high cost of living and taxes, crime plagues the city, further driving away people and businesses. All this culminates in the fact that we may be witnessing the fall of big-tech’s old empire.

2. Houston

Houston is a bustling Texas city with one of the most promising occupancy rates in the country… so why it plagued by so much empty office space?

The current market saturation is attributed to the overzealous construction in years past. When interest rates were low, developers rushed on the opportunity to build in a region characterized by burgeoning popularity and low taxes.

|

“Houston and Dallas put up more new office space between 2010 and 2021 than all regions except New York. Despite the disruptions of the pandemic, they still have millions more square feet under construction. Vacancies now are higher than any other metro area, despite attempts to fill the gaps with heavy discounts.” -Yahoo Finance |

So even though there’s been consistent demand, the supply continues to outpace the need. Coupled with a pullback in the energy sector, the city’s major industry, Houston’s vacancy has skyrocketed. But, the current vacancy rate only tells half the story because occupancy rates are another critical component to consider when projecting which markets are in worse trouble. Read about The Relationship Between Occupancy and Vacancy Rates.

Despite this, the city (and south in general) has been more successful at bringing workers back to the office. So, the vacancy is met with a curiously high occupancy rate. Because even though the demand may seem low from the vacancy rate, the offices are on average more populated and thus the market is poised for long-term success as vacancy rates may flatten out.

This makes it a more promising and stable investment than places like San Francisco that also have low occupancies.

3. Dallas

Another Texas city is landing at the top of this lease. The Dallas-Fort Worth area is home to over two dozen Fortune 500 companies, the city also accounts for one-third of Texas’s $1.8 trillion economy. So again, why is there so much empty space?

Dallas suffers the same fate as Houston, overzealous developers pouncing on low interest rates. Now, in the central business district, the vacancy rate reaches a high of 31%, according to CoStar.

Professionals are worried by what kind of trouble this signal is on the horizon. This is further highlighted by the stress of 20.0% of Dallas' office loans set to mature by 2025. Now, maturing office loans doesn’t spell out the potential end of a market, but does fly up as another red flag for tenants looking for reliable, long-term success in their commercial real estate.

|

"The risk that we have is with the high vacancy and the hybrid-remote work challenge still playing out, losing a large tenant to another building or a major downsizing within the building could change that formula and tip the balance negatively." -CoStar |

Dallas is now on a watch-list as professionals watch the the precarious leasing environment play out.

4. Los Angeles

Leasing activity in the first quarter of 2023 was down 37% from this time last year. The office availability rate has reached its highest threshold recorded and the sum of vacant, soon-to-be-vacant and available sublease space is now up to 26.2%.

Record poor activity is highlighted by the now looming 21.5% of office loans maturing by 2025.

“Los Angeles is another market with a wall of office maturities on the horizon — more than 7% of the metro’s office stock is subject to a maturing loan this year, and Brookfield’s default on $784 million in loans on two office towers in downtown L.A. hints at what’s next for office owners,“ according to the Commercial Edge.

The city has been hit harshly by rising inflation, interest rates, and new legislature like the Transfer Tax which levies a 4% tax on all residential and commercial sales that trade above $5 million and 5.5% on all sales above $10 million.

All this economic uncertainty and expensive red tape is sure to further tie up the office market in 2023 and beyond.

5. Chicago

It’s not necessarily a surprise that Chicago appears on this list. The circumstances in Chicago and Illinois in general have pushed away many of its businesses already. An already-complicated regulatory environment coupled with rising crime and high taxes are not necessarily characteristic of an area where businesses can make money.

In the last year, Illinois lost 3 of its 35 Fortune 500 companies. Citadel, Boeing, and Caterpillar. On top of this, tech giants Meta and Salesforce put up a combined 240,000 square feet for sublease in March, further throwing fuel on the fire on an already record amount of available space on the market.

Now as 23.0% of office loans are set to mature in the next two years, things may get worse. On top of this, excess supply from over-construction is set to further exaggerate the low demand for space and rampant vacancies.

High Vacancies Translate to More Opportunities for Tenants

All is not lost for prospective or existing office tenants. Even though high vacancy rates indicate more potential trouble on the horizon, we may be seeing the worst of it now.

|

“We forecast occupancy rates to start improving before 2025, and indeed that has already been the case for a number of markets, especially those in the Sun Belt, which benefit from population migration trends, less new office supply growth and less propensity for remote working.” -Moody’s Analytics CRE |

And in the meantime, this situation also presents opportunities for tenants to negotiate favorable deals and lower rates. As we move forward, it is crucial for property owners, investors, and tenants to closely monitor the evolving market dynamics and adapt their strategies accordingly. The commercial real estate landscape is shifting, and those who are able to navigate these challenges successfully will emerge stronger in the long run.

The office vacancy rate is the highest it’s been in decades across the country and in some places, it’s going to increase further. As under-occupied leases reach their expiration, consider how much space is set to become available.

There is sure to be a tidal wave of office space set to hit the market. And for tenants this means that they will be exposed to a windfall of opportunities when it comes to office space.

Not only are there more properties to choose from, but landlords in these areas will be more incentivized to create attractive deals to lure in tenants. This means more likelihood that you find the best possible property on the market for the best possible rights and terms.

But in order to fully seize this opportunity, you have to be prepared. Learn the tips, tricks, and trusted techniques that empower corporate tenants to find the best office space on the market for the best price and terms available in the free course below.