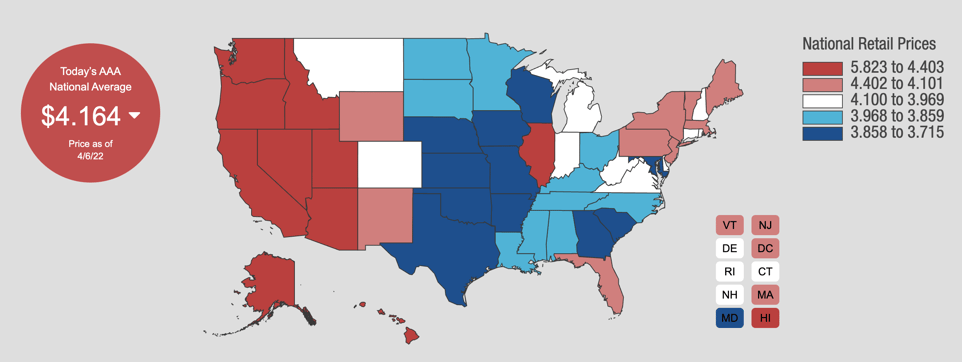

Recently, skyrocketing gas prices have been the most expensive in US history. With the American average price per gallon reaching $4.16 (as of 4/6/22), your last trip to the pump likely costed you more than it ever has.

The surging gas prices are wreaking havoc on industry, driving up the nation’s inflation rate, worsening the supply chain crisis, thus increasing the cost of doing business.

How does this affect your CRE?

Well, prices are going up across the board. If you are in business-unfriendly areas like California, the severity of this crisis is far worsened. There, gas prices reach almost $6.00- a figure that is proving catastrophic for individuals and businesses alike.

(Data according to AAA)

These overhead costs are no longer a sustainable model for businesses, forcing them to adapt. As tenant reps, we have seen how the priorities of our clients’ commercial real estate requirements have changed in recent years. Global and socioeconomic factors have forced corporate professionals to adapt their CRE portfolios. We have been there to help.

Gas prices and other global factors will continue to further shape commercial real estate. So, if you’re looking to learn how these changes may appear, read on. In this article, we will discuss how:

- Elevating gas prices are reinforcing the Work From Home (WFH) Movement

- You can adapt your CRE to keep up with changing demands

- Inflation from gas prices makes Business More Expensive

- The features prioritized by corporate spaces have changed

- You can lower CRE costs

Rising Gas Prices are Reinforcing the Importance of Adapting Corporate Spaces

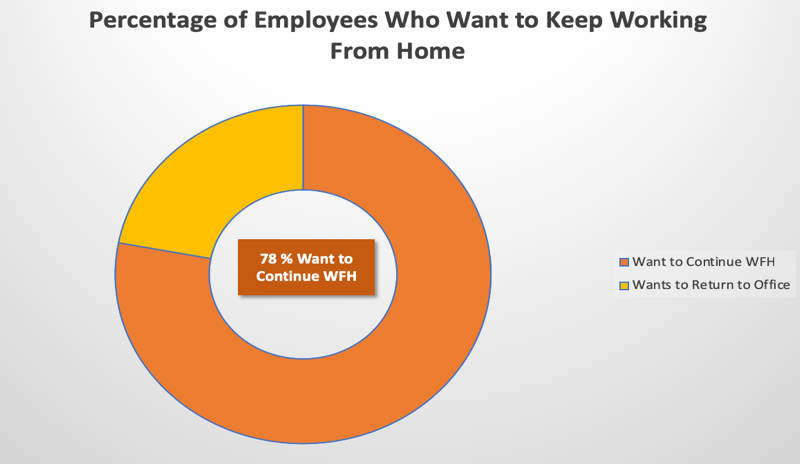

The demand for flexible working schedules has been reiterated with rising gas prices.

The WFH and WFA movements have fundamentally shifted our perception of corporate environments. In addition, working from home has saved employees money and time, two things most are reluctant to give up.

People who have become acclimated to hybrid or WFH schedules are more unwilling to reenter working spaces where a long or expensive commute is necessary due to elevated gas prices.

(Data According to PEW Research Survey 2/16/22 )

What does this mean for your CRE?

The WFH and WFA movements are not fleeting. So, if you lease corporate spaces, you can now be more flexible with these properties. Here are three ways to adapt your corporate real estate to changing demands.

1. Relocate to Business-friendly Areas

Gas prices are higher in business-unfriendly states, so talent in these places will likely be less willing to drive into the office.

To convince your workforce to come back to the office, you can look to relocate to alternate geographic locations where the cost of living and gas prices are lower. Accordingly, they may be more willing to commute.

2. Right-size Your Space

If you are adapting to the demand for WFH by operating on a hybrid or selective in-person schedule, you likely are paying for wasted office space.

The situation will likely worsen as gas prices continue to rise. If most of your employees are working from home with no plans of returning, you can possibly reduce CRE costs by tracking your utilization.

This exercise will allow you to critically evaluate your space requirements. While offices of the past confined employees to 100-150 square feet, corporate spaces today are doubling that requirement.

Ensure that your employees still coming into the office are being met with appropriate and comfortable space.

Right-sizing will also point out the areas of spatial inefficiency within your portfolio. Cutting down on these areas will improve your budget.

3. Renegotiate With Your Landlord

There is a low demand for office space, worsened because now people don’t want to make expensive commutes. So, if you are looking to sign on for a longer-term, your landlord will likely bend over backward to continue their cash flow. As a result, you may be able to reset your rent payments to the current asking value of properties within your market.

If you want to cut down on square footage after finding that you are paying for wasted space, you could possibly renegotiate your space requirements for a longer-term.

Overall, this crisis is forcing organizations to rethink their requirements for physical space. Renegotiating will possibly allow you to adapt your existing office lease to fall in line with your current requirements.

Gas Prices Drive up Inflation- based CRE Costs

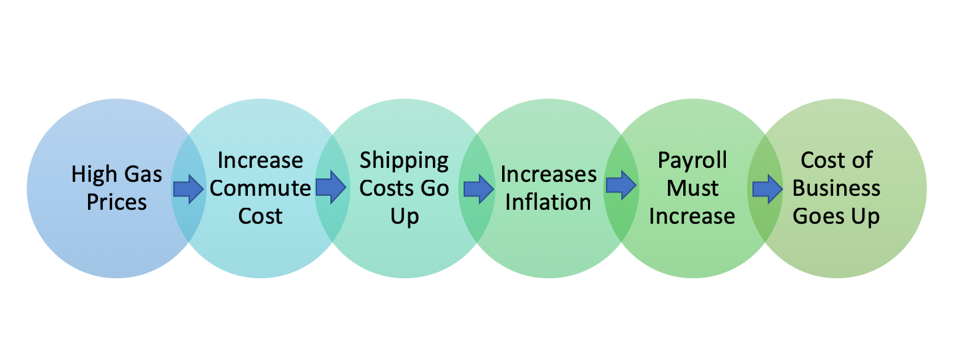

High gas prices have an adverse effect on the nation’s entire economy. Gas and other fossil fuels are the backbone of our shipping industry. Therefore, when gas prices rise, the price tag for everything increases.

Gas prices are a link in a never-ending feedback loop, actively influencing the cost of living. Accordingly, payroll rates will be forced to become more expensive to keep up with necessary salary requirements to live comfortably.

This means overhead costs for businesses will go up. It’s not just payroll, though. When everything becomes more expensive due to the supply chain, the price of office expenses will be driven up.

Landlords will want to pass along these extra costs to tenants. That is why it is so critical to work with an expert who will protect your interests, like a tenant rep. They can negotiate on your behalf to avoid hidden costs or elevations due to inflation.

Consumer Price Index (CPI) Rent Escalations

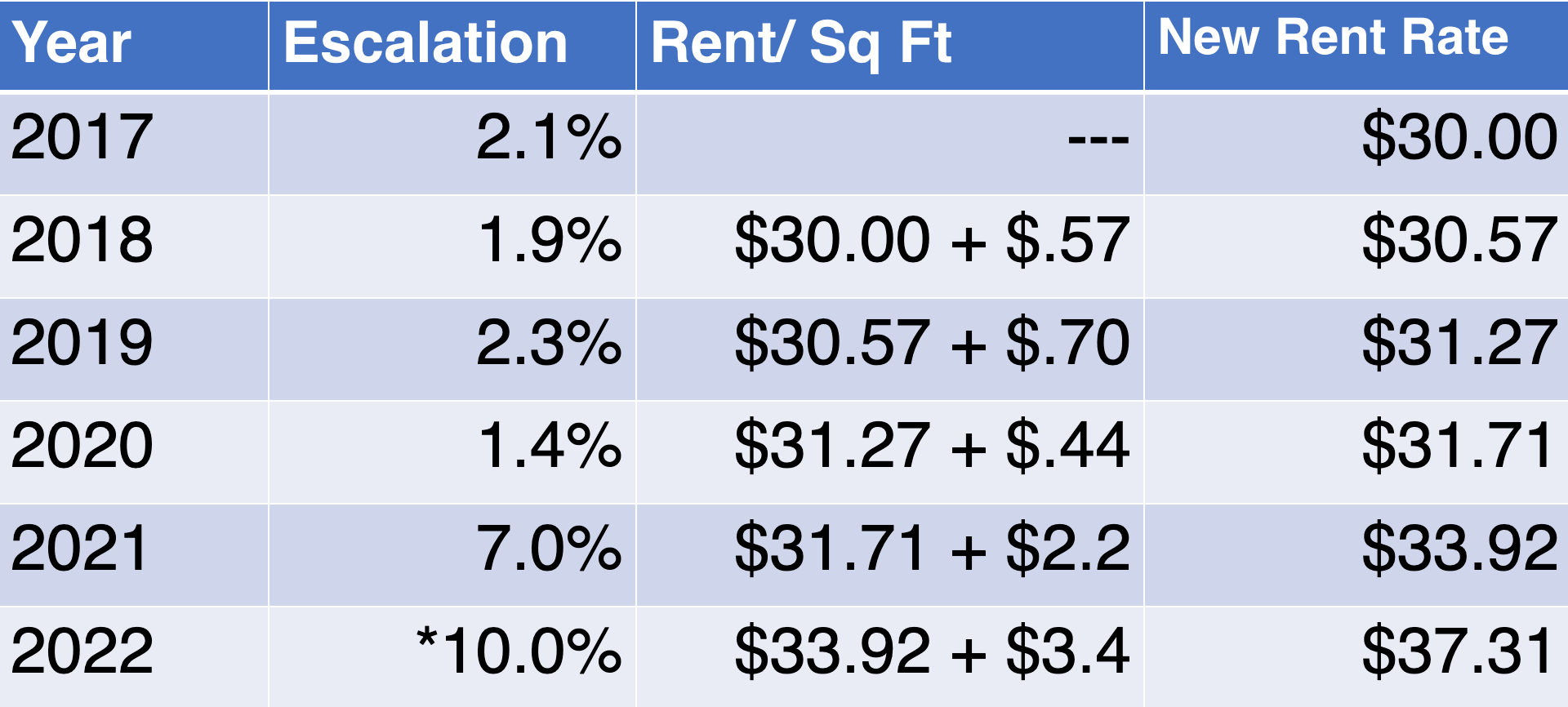

If you signed off for corporate rent escalations according to the CPI, good luck. As discussed, gas prices are driving up the cost of inflation. For tenants with CPI escalations, this means expensive monthly rent payments.

Remember that these escalations are compounding, so you will always feel the weight of elevated inflation even if inflation rates go down the following year.

With current rates so high, landlords would want nothing more than to sign you on to an escalation, according to the CPI. If you work alone or with a conflicted broker, you could be stuck with these payments.

Your office space may become more expensive due to gas’ influence on inflation.

Let’s look at how quickly your escalation rate could spike if you leave yourself vulnerable to inflation. Who knows how severely the CPI will increase by the end of 2022.

(* Estimated)

Cost of Operating Expenses Goes Up

Operating expenses can also be elevated to the CPI depending on your agreement with your landlord. If this is the case, you will not only pay expensive rent due to inflation, but you will also be responsible for more expensive utilities.

Your CRE budget will have more gas thrown on the metaphorical fire as overhead prices become out of control.

Again, that is why it is so critical to work hand in hand with a representative. They will outline all the possible ways you could lose money to poorly negotiated lease terms. If you do not define a cap for operating expense elevations, your landlord could do anything to make sure you feel the brunt of inflation rather than them.

Expensive Gas is Changing the Preferred Features in Buildings

The increasing price of gas and other fossil fuels does not likely have an end in sight. As a result, many people are looking for alternative means of travel.

Electric vehicles are emerging as a long-term solution for many Americans looking to evade volatile prices at the pump. As the number of Americans with EVs goes up, so will the demand for parking and charging stations.

If you are an employer, this means providing charging stations in parking areas. The chances are that if you have returned to the office or found new space since COVID, the necessary amenities and layout have changed.

Adding features like EV charging stations is another step you can take to stay up to date with cutting-edge office trends.

The companies that equip their office spaces with the latest features will have better luck finding and maintaining great talent.

What You Can Do to Lower CRE Costs

If you take anything away from this article let it be the following points:

- Consider moving all or part of your operations to a business-friendly city

- EV chargers are not an amenity- they are a necessity

- Embrace a hybrid work model

- Prioritize employee commute times in your Key Site Drivers (KSD’s)

- Work to optimize your CRE portfolio for the future workforce

As an organization, you need to optimize your space and CRE budget. This may mean that the office in NYC or San Francisco does not make sense anymore.

In those places, you are victim to higher living costs across the board. With gas prices driving up inflation more in those areas, the power of the dollar is far weaker. For example, the amount you could save per gallon by moving from California to Texas is almost $3.00!

By moving to a business-friendly area, you could slash your overhead costs. This means that you can find your optimal features at better prices. In addition, when you can afford to stay up to date with cutting-edge features, your property could make your recruiting abilities more competitive.

How a Tenant Rep Can Help You Lower CRE Costs

If you are curious about how to achieve a move to a business-friendly area, you can work with a tenant rep. Their depth of market knowledge prepares them to support your move from the decision that your current CRE isn’t working to negotiating with your new, prospective landlord.

They know the best places to look for business, the must-have clauses in leases, and negotiation methods to secure you the most affordable price.

Overall, remember that you have more flexibility with your CRE than you may think. WFH/WFA have fundamentally shifted what we view as possible in correlation to the corporate world. Now is the time to assess how this can improve your bottom line.

Check out this article to learn more about the benefits of working with a tenant rep!