In this article, you'll learn:

- How relocating from NYC can save on rent and operating costs.

- The benefits of right-sizing your office space to reduce expenses.

- How renegotiating with landlords can further cut costs.

- The overall impact of the three R's (Relocating, Right-Sizing, Renegotiating) on your CRE portfolio.

Real estate is typically an organization’s second or third most significant cost. When you are dealing with expenses of that magnitude, you want to be ensured that you are making the right decisions with your corporate real estate portfolio.

It’s easy to lose track of what that even means. The market is ever-changing, and it can be challenging to keep up with the latest CRE trends to save money. Luckily, you don’t need to.

Tenant reps are real estate experts who specialize in maximizing the savings and efficiency of their corporate clients. This means working with market trends to capitalize on their benefits, but also holding on to tried and true methods of optimization. Through being present in the industry for over three decades, we have identified the most wholesome approach to finding the best properties and savings.

The three R’s are an evergreen solution to closing in on excessive real estate costs. They offer three options: Relocating, Right-Sizing, and Renegotiating. Depending on your organization’s CRE goals, your needs could fall into any or all of these categories.

To highlight what they are and how you can take advantage of them to save, read on. You will find that properly utilizing this system will reduce your overall costs to a fraction of what they were.

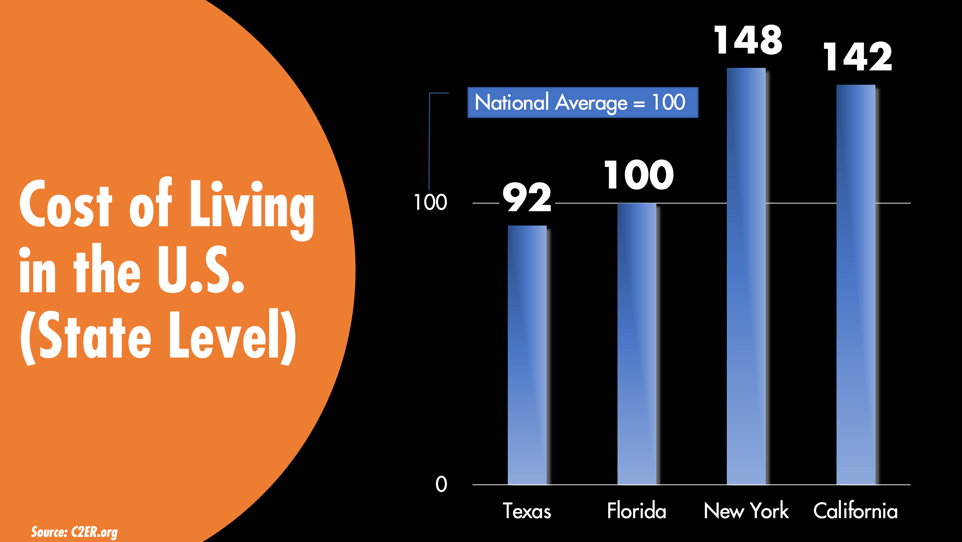

For this exercise, let’s say that you are currently located in New York. As you know, it is costly to operate a business in Manhattan. You are faced with elevated taxes, payroll, rent, and just an overall higher cost of living.

There is currently a major push amongst organizations, tired of the overhead expenses, to move outside the city. So let’s go through the savings a New York tenant can experience if they move their business outside of the state.

3 Ways to Cut Costs if You Occupy Space in NYC

Let’s say that you have 50,000 square feet of NYC office space. There is about a year left on your lease, more than enough time to plan a move. However, to put more pressure on the matter, your landlord is offering you a five-year extension to remain in your existing space.

Well, the demand for commercial space is currently low due to the work from home revolution. But, you signed your lease several years ago when rental rates were a bit higher. The current average price for NYC office space is $70-75 per square foot. You’re paying $80, and should you choose to stay you would also be subject to additional rental escalations.

If New York is right for you, then New York is right for you. However, if you are open to other options, you could fall into incredible savings; let’s go through how.

1. Relocating

Relocating is a tough decision for an organization to make. However, if you have already decided that your current space doesn’t work for whatever reason, you’ve completed half the battle.

The big question then is, where should you move?

There are a lot of attractive regions for businesses sprouting up in the last few years. One of them is Jacksonville, Florida. With the state quickly becoming the “Wall Street of the South,” there are a lot of businesses taking advantage of its lower overhead costs. You’re not limited to Florida, of course. There are numerous business-friendly areas you could look to.

For the purpose of this scenario, though, you decide after extensive deliberation with your team and real estate rep that Jacksonville may be the best place to shift your operations. The average rent price is too tempting to deny at $27 per square foot for Class A buildings.

At market prices, five years in Jacksonville will cost you $6.75 million. Your yearly rent expense would total roughly $1.35 million.

However, if you choose to stay in New York for the next five years, at $80 per square foot, you are looking at a flat rate of $20 Million! This doesn’t even account for escalations, taxes, and operational expenses.

For five years, the same office building in Jacksonville will initiate a $13.25 million in savings, in rent alone, opposed to remaining in New York.

2. Right-Sizing

There is more room to cut down on costs within our discussed scenario. Measuring your current space utilization is a critical step to running at your most optimal CRE performance. If any of your properties are over or underutilizing space, you have room to benefit from reassessing your current square footage.

Right-sizing can mean many things. First, it is a deep dive into your portfolio to analyze where and how your utilization can become more efficient. For organizations with employees working at desks in hallways, it means expanding. On the other hand, if you have sent your employees to work from home and there is no end in sight, it means cutting down on the resulting wasted space.

Wasted space is expensive. Keeping track of your utilization will avoid it.

So let’s say that many of your employees are happy working from home. Through reassessing your necessary space, you find that you could stand to cut down 40 percent. Times have changed, and now you only need 30,000 square feet for your employees still coming into the office.

The 30,000 square feet at $27 will cost you about $4.05 million. So with this metric, we have reached $16 million in savings.

3. Renegotiating

We have still not reached the final tier of savings. The value of skillful negotiation can not be overstated.

The market has opened up for tenants. As many businesses have shifted online, landlords are now threatened by the potential of having vacant space. Properties without tenants to fund them are extremely expensive. To cut down their losses, landlords are more willing than ever to agree to favorable terms and features for low prices.

If you come prepared with a representative, you stand to save even more. Tenant reps are experts in leveraging the value of your tenancy against landlords and their brokers. They often do this by creating competition amongst landlords. This critical step incentivizes them to drive down their rates in the hope of landing you as a tenant.

The process of skillful renegotiation has seen clients reach savings of 30 percent. Let’s be conservative here and say that your tenant rep creates 25 percent savings during arbitration in our scenario.

Now we are looking at a little over $3 Million in rent for a leasing period of five years! Do you remember how expensive it was initially in New York? $20 Million. This is a savings of 84.81 percent.

How The Three R’s Can Improve Your Portfolio

When using the three R’s, you have the potential to save almost 85 percent in your CRE overhead. This metric only considers rental expenses. If you move to a more business-friendly area, you can also save on payroll, taxes, gas, and overall cost of living. In addition, since these places are cheaper to work and live in, the power of the dollar is stronger. Consumers have more of an ability to freely spend, potentially furthering your financial benefit from moving.

All said and done, the Three R’s is a process that promises efficiency and savings. However, it requires a great deal of soul searching on your behalf to determine what move would be suitable for your organization. The good news is: you have options. Maybe you would benefit more from an analysis of your space utilization. Or, perhaps you want to stay in your building but want to renegotiate your rent to market value. You have the power to utilize this sequence even if you are not comfortable with a significant move.

Now, this process can seem incredibly daunting. But, if you are overwhelmed by the steps and the uncertainties, don’t worry. Tenant reps have mastered this process and can help you throughout every stage. Even if you are still unsure if you could benefit from the three R’s and want to work with a rep to assess your needs, they are available for you.

Looking to learn more about relocating? Check out this article!