In a leasing environment where office landlords are defaulting left and right, tenants need to do what they can to protect themselves.

Enter the Subordination Non-Disclosure Attornment clause (SNDA) – a powerful weapon in the arsenal of savvy commercial tenants. Should the unthinkable happen and your landlord defaults, this vital clause actively secures tenants' rights and priorities as in all things legal, you should consult a qualified commercial real estate attorney, but when office landlords are falling like dominos, the onus in on tenants to step up their due diligence and safeguard their tenancy.

Let’s discuss the importance of the SNDA in commercial leases and how it can provide tenants with the necessary protection and leverage to navigate lease negotiations and mitigate risks associated with landlord defaults.

Precarious Leasing Environment

Landlords who once enjoyed steady cash flows from long-term lease agreements are now facing mounting challenges in attracting and retaining tenants. Because since businesses embraced remote work options, many companies who do still want corporate space have downsized their office footprints or transitioned to hybrid work models.

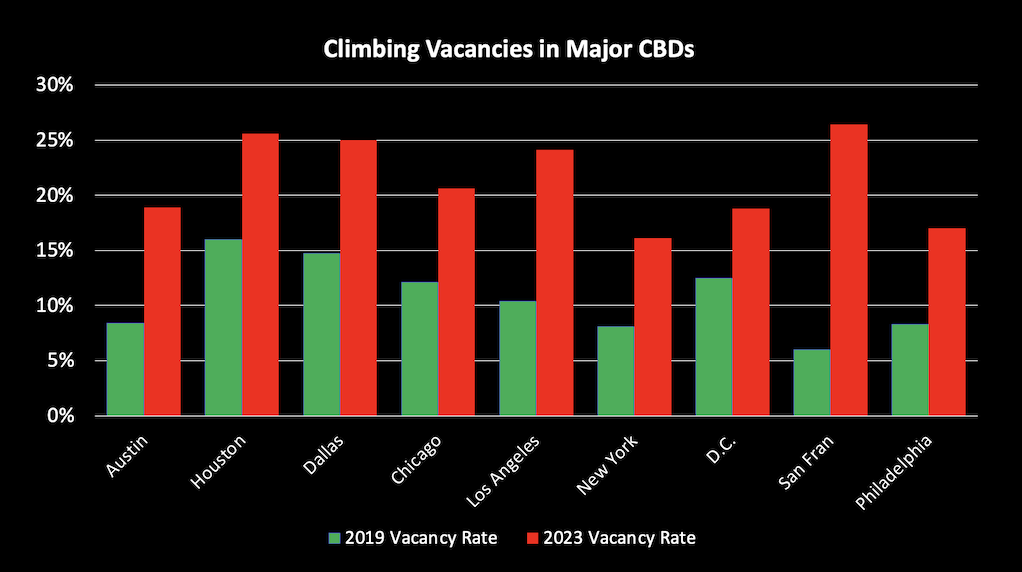

The reduced need for office space has resulted in a surplus of vacant properties and an oversupply in the market. What’s worse is that the buildings that do have leases are likely under-occupied and thus at greater risk of becoming vacant once the leases come due. This problem is so rampant that in some markets, the average occupancy rate is under 50%!

But everywhere, vacancies have dramatically climbed since pre-pandemic norms. Learn more about The Relationship Between Occupancy and Vacancy Rates.

In such a scenario, landlords are facing immense pressure to fill these vacancies and maintain occupancy rates. As a result, they’ve greatly lowered their asking rates for base rent and gone more generous on the concession packages. But, when landlords essentially need to fill 89% of their building to break even, how much longer can we prevent the inevitable?

Landlord Defaults are Rising

Commercial tenants should be prepared for the very real possibility that their landlord may be in for trouble. In fact, the odds may be as much as a one in three chance that your landlord’s risk is too much to bear.

|

About 30% of U.S. office buildings, which is translated to a collective estimate of $1.1 trillion are at high risk of becoming obsolete. -data from research analyst for Goldman Sachs, Randall Zisler |

Most buildings have seen their profit margins shrink or go into the red. Some so significantly that the debt service going into the property is no longer possible.

In that case, your lease would likely be taken on by the bank. So, in the event that your landlord defaults, you may be straddled by new ownership.

This can have implications on everything from decision-making processes to the upkeep of your maintenance and essential services. Of course, if this happens, the circumstances will be highly unique to your situation. But regardless, that is why it is so critical to fundamentally outline the terms of your lease in negotiation. You never want to be in a vulnerable position where your best interest is sacrificed should your relationship with your original landlord be implicated.

So how can businesses looking for new space protect their tenancy?

Enter the Subordination, Non-Disturbance, and Attornment Agreement (SNDA)

An environment where major landlords are defaulting at exponential rates is uncharted territory. Because there’s no telling what would happen to existing tenants in the event their lease gets taken over. Several nightmare scenarios can take place (especially if your original lease was outlined by the landlord’s broker) from service disruptions to a looming risk that their right to tenancy is voided.

|

“Though banks would be unlikely to kick out existing leaseholders on taking over ownership of an office building, tenants especially larger ones should get a non-disturbance agreement from a landlord’s mortgage lender as a matter of routine. This means the bank would have to recognize the existing lease of the tenant if it took over the building.” -The New York Times |

If you’re signing a new lease, ensure that you receive a Subordination, Non-Disturbance, and Attornment Agreement (SNDA) among yourself, the landlord, and the landlord’s lender. This guarantees your right as a tenant to the leased premises in case of landlord default or foreclosure. The SNDA allows the tenant to keep occupying the property according to the existing lease terms, even if the landlord loses ownership.

The SNDA should provide additional protection beyond a traditional Non-disturbance Agreement (NDA), but it is important to consult with a lawyer to ensure that the SNDA clause is properly worded.

Once this is baked into the lease, this will protect you the corporate tenant even when a receiver steps in. The receiver must abide by the terms of the lease. However, without this, you may have no legal leg to stand on in the event that your lease’s receiver wants to shake things up and clean house.

No SNDA in Original Lease = No Protection

As with any critical lease clauses, tenants don’t have access to them unless they’re already outlined in the lease. Tenants without SNDAs in this market may not be adequately protected in the event of the landlord's default or foreclosure. Think of it like being thrown into deep water without a life preserver while the boat that took you drives off.

Because not only are you at risk of becoming subordinate to the rights of the landlord's lender which can most assuredly cause disruptions to the tenant's occupancy and business operations. But beyond the obvious, the absence of an SNDA may limit the tenant's ability to directly negotiate with the lender or take necessary measures to alleviate any negative consequences arising from the landlord's default. Therefore, it is essential for tenants to ensure they have an SNDA in their lease to safeguard their interests and maintain a secure position in such situations.

Tenants looking for new space can use it as a powerful weapon in their arsenal. So, it’s not necessarily good news for existing tenants, but the SNDA is something that must be included prior to the lease execution. Learn the other critical considerations to find the best office space with the best terms and price.

This pre-lease negotiation stage offers tenants the best opportunity to assert their position and achieve favorable terms in the SNDA agreement. Because prior to finalizing the lease, both the landlord and the lender are motivated to ensure a smooth transaction. The landlord aims to secure a deal and may even exert pressure on the lender to execute the SNDA. Similarly, the lender, whether the loan has been granted or not, is typically eager to close the loan or secure a tenant who can contribute rental payments towards meeting the required debt-service coverage ratio.

But your landlord (and their broker) probably won’t be willing to hand you over your SNDA on a silver platter. Let’s discuss why and why this is all the more important.

Why Most Landlords Don't Want the SNDA

Understand, that landlords hate any lease clause that diminishes their control. Just as with “self-help” clauses that are gaining notoriety among tenants and landlords now, landlords may drag their feet when it comes to the SNDA. In fact, if you don’t have a skilled tenant representative introduce it, your landlord likely doesn’t even want you to think of the SNDA as an option.

So, in normal market conditions, you can expect significant pushback from landlords or a flat out “no.” However, if you’re a big fish with a lot of corporate mojo and/or taking significant space, this is something that your True Tenant Rep advisor should insist upon.

Now, we are in extraordinary times. Tenants certainly have the upper hand in negotiations. That said, a lot will depend upon the value of your tenancy and the landlord’s overall picture. Because tenants should understand that between the SNDA and self-help rights like the right of offset, the landlord can feel that they are cut out of the deal as the tenant assumes agreements with the bank or lender. So, they must deem the stepping over of their authority as worth it. This means that the SNDA will be contingent on:

- The size of your company

- The size of the deal

- How much the landlord desires your tenancy

- How long your tenant relationship will be, etc.

It's essential to evaluate these factors to determine the feasibility and potential success of including an SNDA in your lease agreement. Remember, the SNDA empowers tenants to assume agreements with banks or lenders, which may require landlords to relinquish some authority, making it crucial for them to consider the value you bring to the table.

That said, with a true tenant representative working for your interests, nothing is impossible. And having such a rep that has a sole fiduciary to getting tenants the best deal dramatically raises the chance that favorable lease terms like the SNDA appear in your lease.

The SNDA and You

The SNDA is a critical life preserver for tenants as landlords everywhere are going under. While not necessarily a typical feature in a lease, it can make or break your tenancy post-Office Apocalypse.

Its growing importance is a reminder that we are navigating a new leasing environment entirely. Tenants have new fears and proper due diligence on their behalf is more critical than ever. So, stay on track of the evolving CRE and office environment by subscribing to our blog. As True Tenant Reps™ we have a fiduciary to the tenant and we carry this over in our content, creating information that helps tenants get ahead. So, if you’re looking to refresh your CRE knowledge or learn about trends in the CRE space that pop up, subscribe to our blog and get invaluable tips sent directly to your inbox.