Wall Street has fallen, and it can’t get up.

As the national economy continues to suffer, many are bracing themselves against the first warning signs of an impending recession.

For business owners, a recession is an imminent and genuine fear. How do you maintain profits without making significant staff cuts?

Well, cutting your real estate costs may be the answer. Behind payroll, commercial real estate is typically a corporation’s highest cost. So rather than look elsewhere, learn how you can save millions by adjusting your current CRE portfolio.

How do we know this? As tenant reps, we have seen how the most efficient method to slash corporate overhead expenses is reducing the price of commercial real estate. We have mastered the process of creating savings in CRE by utilizing the 3Rs™:

So, stop wasting money and learn how to streamline your commercial real estate portfolio before the recession hits.

1. Right-Size Your Space

Do you have any room to improve your space utilization? The chances are, you probably do. Since the pandemic, companies have been lugging around the weight of underutilized space on their budget. Shedding your wasted space will improve the portfolio's efficiency, dramatically reducing your overhead.

How Much Space Do You Need?

The first thing you can do is find your ideal square footage requirements. To do this, consider the current size of your team. However, it may be best to think in terms of seats rather than current employees.

Hybrid and WFH working schedules have changed the way corporations utilize their real estate. Maybe half of your employees are still working from home with no plan of returning. Why would you want to pay for the space they no longer need? Take advantage of this unique opportunity to cut down the clunkiness of your portfolio.

Whether you want to consider the estimated needed seat count or the number of physical employees, devote about 200-250 square feet to each seat.

|

Your most important asset is your people. Ensure they are comfortable and productive in an environment with sufficient elbow room. |

Improve Your Space Utilization

Once you have your ideal utilization, compare it to your current usage. How can you reduce the divide between those figures? If your lease ends soon, you can negotiate for reduced square footage. Or, if you can’t cut your space now, sublease out the areas you are not using. This is a great way to make back some funds that would have been purely wasted.

If you are an organization with 25 - 50+ locations, the likelihood of having wasted space is greatly elevated. You could be wasting millions of dollars that can easily be reclaimed. This is why you want to speak to a tenant rep sooner rather than later. They'll point to areas of waste within your CRE portfolio. If you have a larger portfolio, the potential savings add up as you cut down on extraneous space per location. You may wind up saving millions by streamlining your portfolio.

Optimizing your space doesn’t just mean cutting space (even though it’s a great way to reduce your budget). Instead, optimizing can mean combining satellite locations, subleasing space you can’t shed, or renovating your properties to make them more productive.

Know that you have numerous options to improve your utilization.

2. Renegotiate Your Existing Lease

Since so many companies have found success working from home, the demand for commercial real estate has dropped dramatically. As a result, rent prices have largely dwindled.

Reduce Your Rent to Market Value

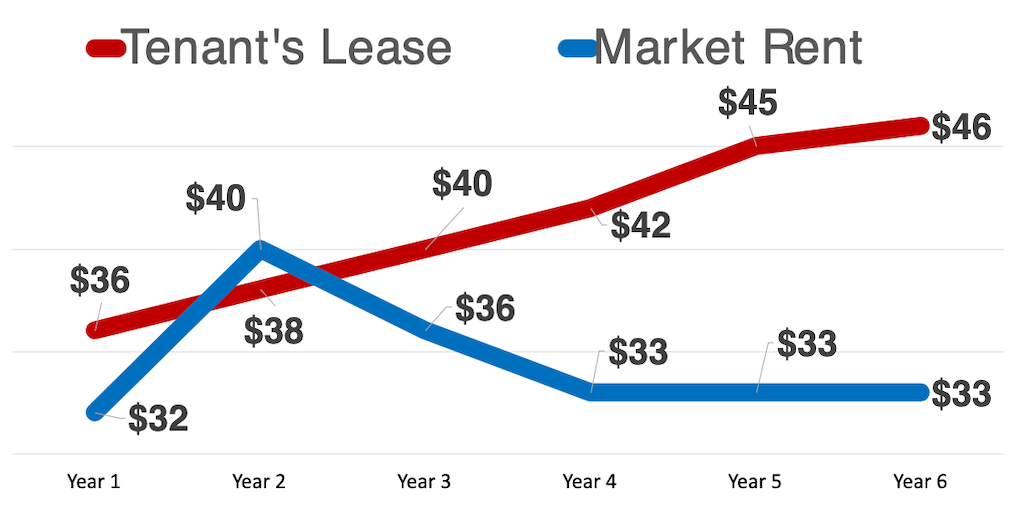

If you’ve been in your current space for a while, you’re likely paying over market value payments each month. With the market behaving the way it has been (and inflation increasing daily), your compounding escalations and higher starting base rate are draining your budget! You could save millions over the term of a lease by reducing your rent to market value.

If you want to extend your lease in your current building, take up extra space, or look for a new lease, you are in a position to renegotiate with your landlord. Reducing your rent payments, taking on a period of rent abatement, or receiving other perks will reduce the overall spending on CRE.

In a recession, this is critical. Why should you pay the high base rent from when you signed your lease, compounded with yearly escalations? Corporate tenants are currently finding office space for highly affordable prices, so you shouldn’t be barred from benefitting just because you already have space.

In the current market, businesses are looking to save money wherever possible. Skilled negotiation can bring on a sustainable financial windfall for the wise tenant.

3. Relocate Your Commercial Properties

As mentioned above, due to the performance of the market and the low demand for commercial real estate- you may be able to secure the best deal by finding new space. Even if your landlord is willing to renegotiate, they will likely have no incentive to lower your rate below market value.

Finding new real estate may be the most efficient way to bring substantial financial gains. This is especially true if you are open to an out-of-state move. The corporations that gave the most to gain from relocating are located in business-unfriendly states. By moving to an area that encourages corporate growth, you will save in:

- Corporate income tax

- Personal income tax

- Overhead expenses

- Cost of living

- Payroll

- Real Estate

Relocating to Business-Friendly Areas

Business-friendly areas have been inspiring a corporate migration in recent years. Their affordable living costs and favorable regulations make them a very real method for organizations to save dramatically.

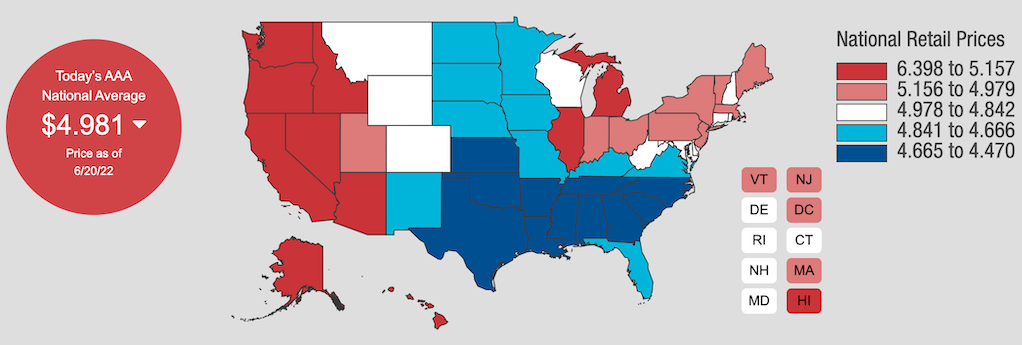

Getting away from the business-unfriendly states should be on the top of mind for every CFO. It is simply no longer feasible to pay for dramatically elevated expenses, especially gas. Unfortunately for us as Americans, runaway gas prices are only another symptom of the approaching recession diagnosis. For example, with the current gas prices, some in California are paying almost $7 per gallon!

Other than this being an egregious metric, it is worsened when you compare it to more affordable states. When you see how much you could be saving in gas alone, why would anyone think it's sensible to stay in business-unfriendly states?

Other Options for Relocation

However, know that you don’t need to make a substantial move to benefit from relocating. It may be time to find a new building. Whether this means the property is down the street, in the suburbs, or across the country, you will likely reduce your base rent significantly. Many companies are cutting their overhead by simply moving to the suburbs. There, they improve their budget by avoiding excessive living costs and regulations.

No matter where you want to relocate, know that this is an excellent option to reduce costs in a highly volatile time.

How a Tenant Rep Can Help in a Recession

If the country’s economic performance has proved anything to the corporate tenant, it’s that we can’t think of our commercial real estate portfolio the same way. Organizations no longer have room for extra expenses.

|

The importance of streamlining the efficiency of your properties is more pressing than ever. |

Right-sizing, renegotiating, and relocating are three authentic methods to reduce your spending in a recession. However, they are also evergreen, proven processes to improve your commercial real estate in any fiscal environment.

As tenant reps, we have invented the process of the 3Rs™. Through working with hundreds of corporate clients at iOptimize Realty®, we have fully developed the methodology that will find the best properties, optimal lease terms, and lowest prices.

Don’t wait until it's too late, and take a good look at your real estate today. Know that, you never have to do it alone. A tenant rep is a reliable and invaluable asset to achieve your optimal CRE performance.

Find out how a tenant rep can help you today.